General Overview of Cashew Production

Cashew (Anacardium occidentale L.) consists of the nut and peduncle. Separation of the nut from the apple results in two unique products. In general, fresh cashew for consumption last for only 24 -48 hours at room temperature. About 90% of the harvestable product from the cashew tree is lost through wasted cashew apples. The complete development of cashew fruit (cashew nut + apple) from flowering to physiological maturity takes about 70 to 90 days.

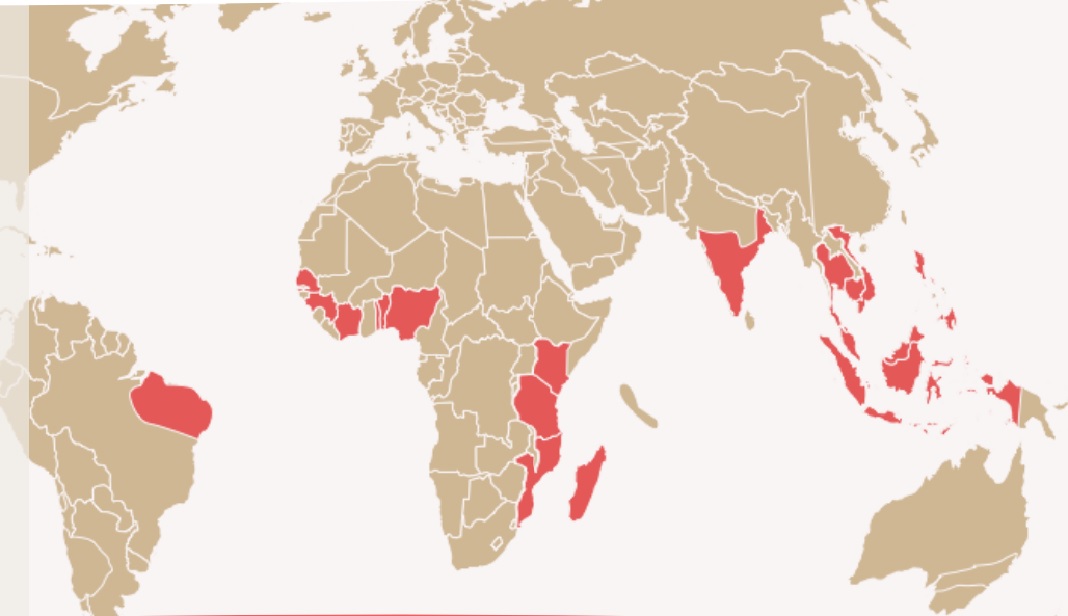

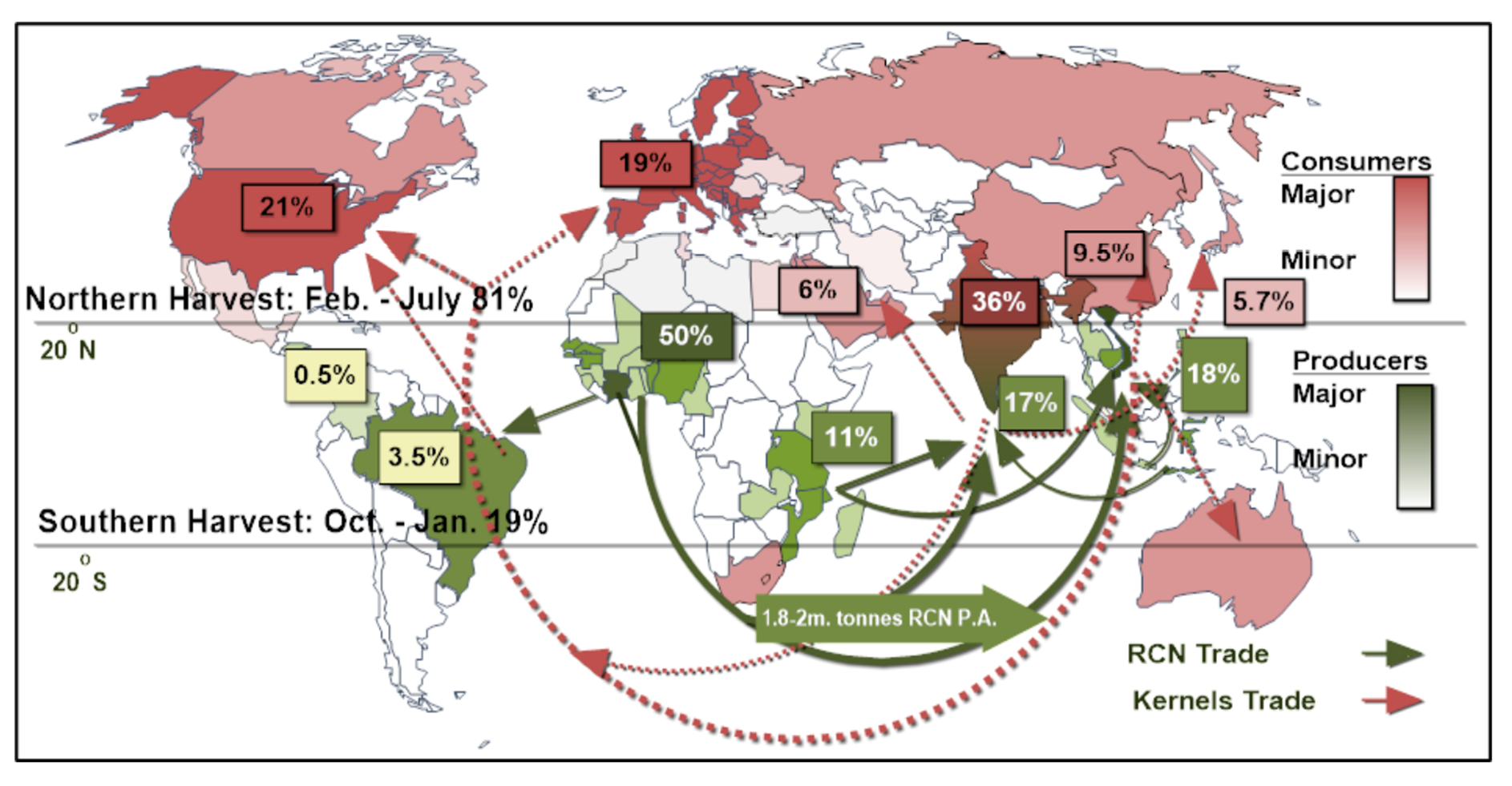

The cashew tree grows in tropical climates with an annual rainfall ranging from 400 to 4,000 mm, and it grows from sea level to an altitude of 1,000 m. The Cashew is cultivated primarily in India, Vietnam, Côte d’Ivoire, Guinea-Bissau, Tanzania, Benin, Brazil and other countries in East and West Central Africa and South East Asia. Plantings have also been established in South Africa and Australia.

World production of cashews currently ranges between 720,000 and 790,000 metric tons (kernel basis) per year (seasons 2015/16-2019/20). India, with 170,000-195,000 MT of annual production, ranks first, followed by Côte d’Ivoire, Vietnam and Tanzania averaging 149,000; 82,000 and 53,000 MT, respectively.

World cashew production is growing at an average rate of 6% per annum, driven by the rapid expansion in West Africa with a growth rate of 9% a year. West Africa has a rare blend of the tropical climate, deep soils, and availability of land. This combination creates an unmatched comparative advantage for West Africa to be the new frontier of expansion of the world’s cashew production.

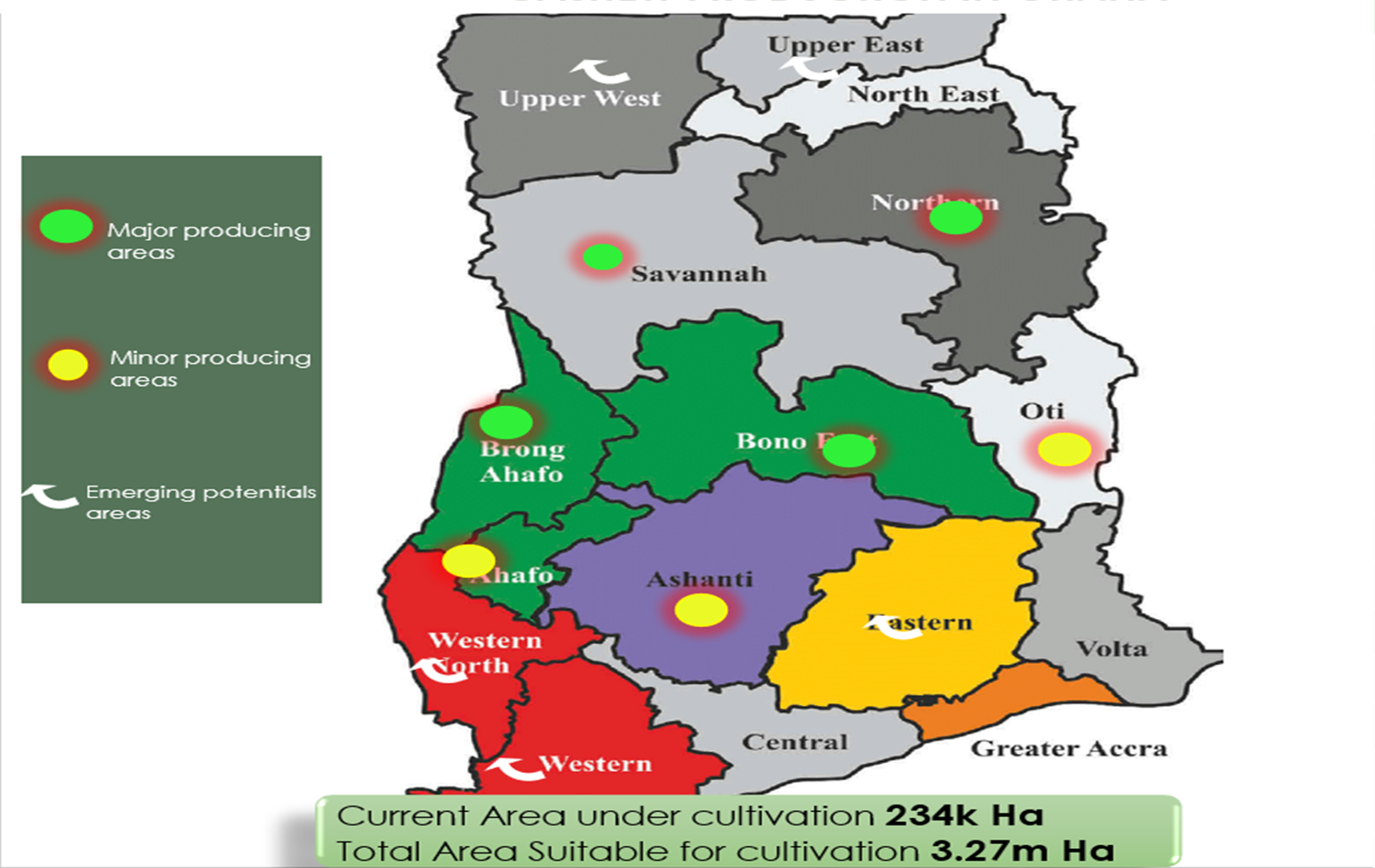

In Ghana, it is grown mostly in the forest-savanna transition, guinea savanna and coastal savanna areas in regions such as Bono, Bono East, Oti, Savanna, Northern, Upper West and Upper East; parts of Ahafo, Ashanti, Central, Greater Accra and Volta regions. The region of West Africa is the second-largest producer of cashew nuts, but it is also the region with the lowest processing capacity.

Cashew Production Areas

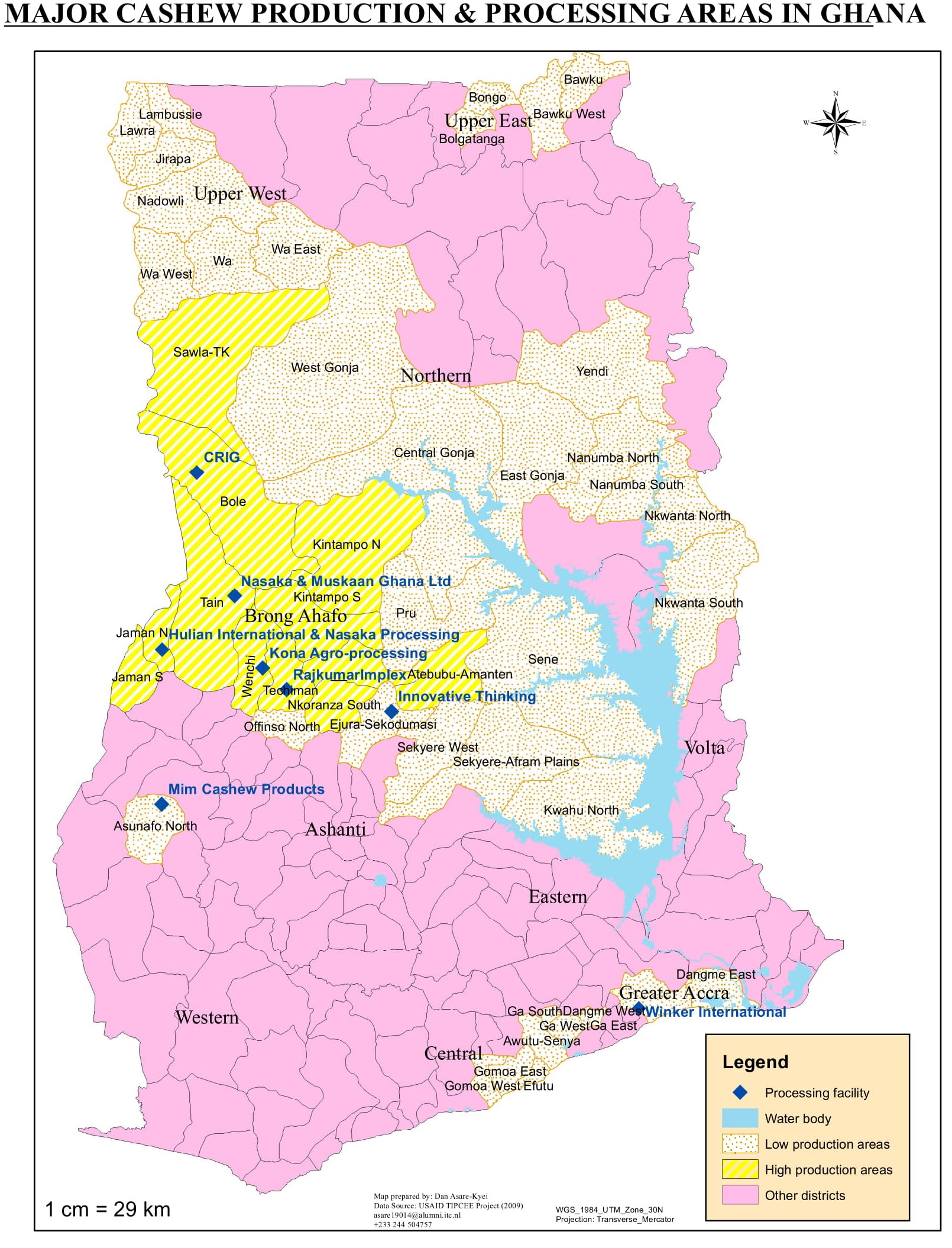

According to the Cashew Industry Association of Ghana, there are over twelve (12) large and small-scale processing companies in the country, with over 27,000 mt installed processing capacity, 88 per cent of the nation's installed capacity is located in the Bono and Ahafo Regions. The top brands in this area include Mim Cashew Products, Kona Agro-Processing Ltd, and Cash Nut Foods Ltd. The total processing capacity has increased to more than 60,000 mt as a result of the inclusion of Usibras in 2014, Brazil's largest processor, with its 35,000 mt plant.

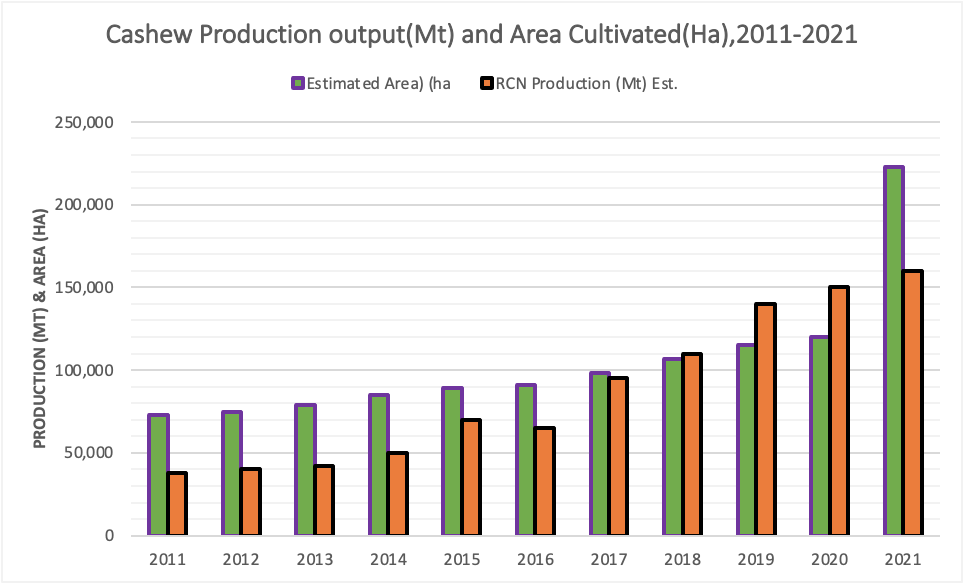

According to MoFA, cashew production in Ghana increased from 95,000 tonnes of Raw Cashew Nuts (RCN) in 2017 to an estimated 160,000 tonnes in 2021. During the same period, the area under cultivation increased from 98,000 ha to 223,020 ha with a sharp increase recorded between 2020 and 2021 (over 103,020 ha). The additional hectares are yet to yield fruits because they may be young.

Figure 2: Estimated production output and Area Cultivated, 2011-2021

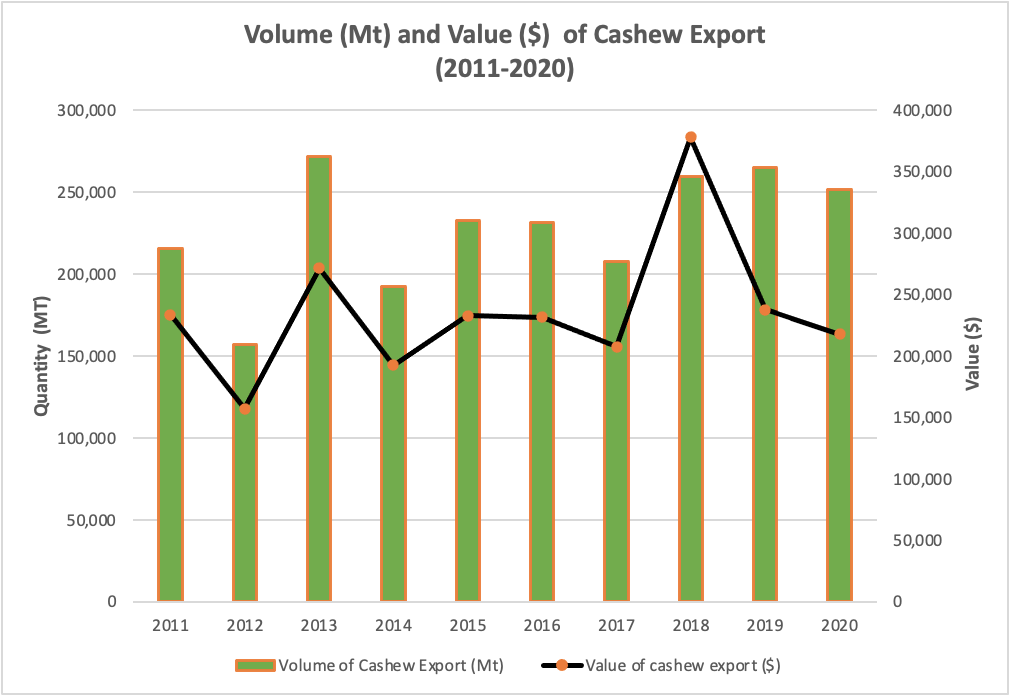

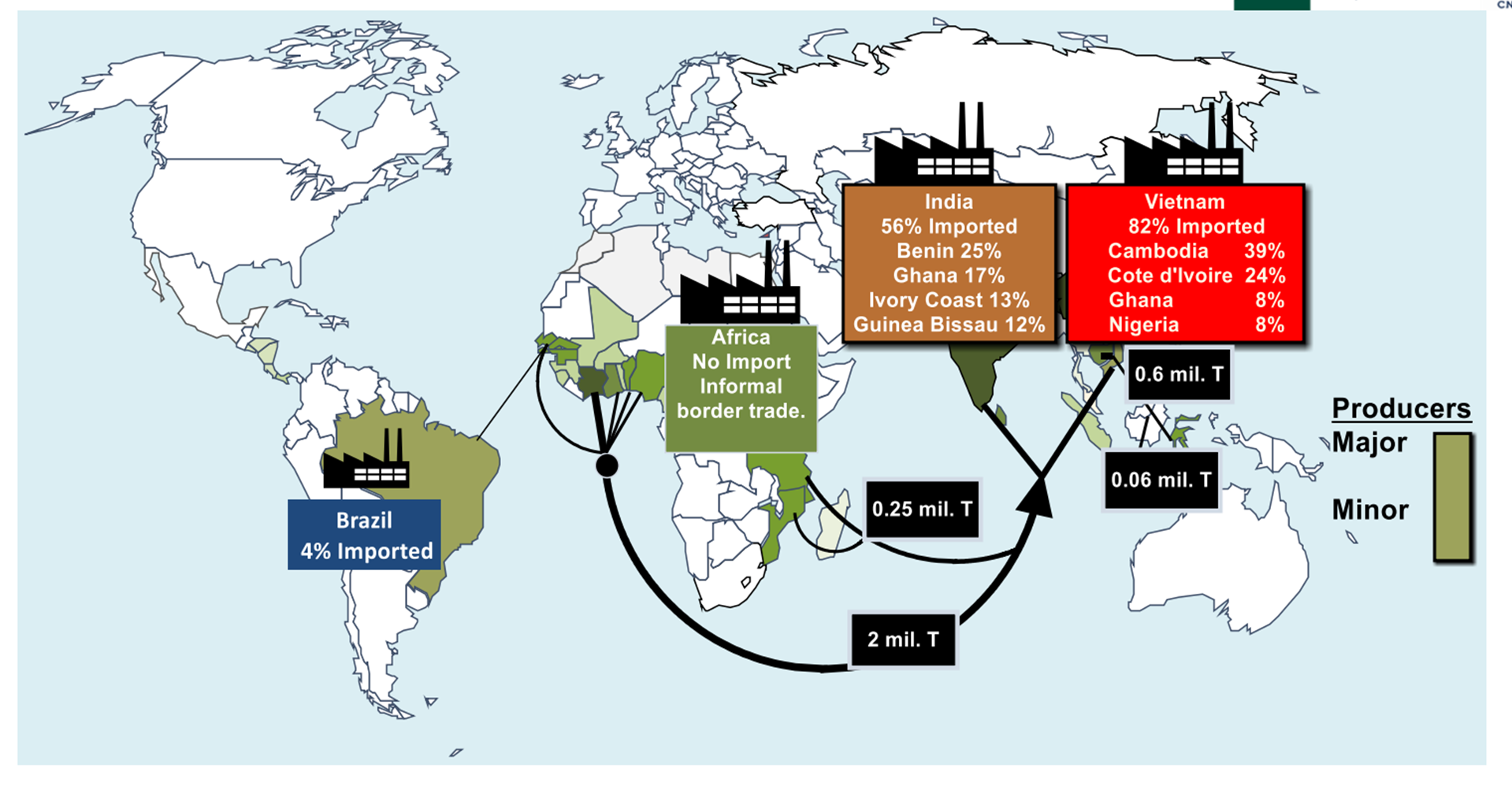

According to the GEPA 2021 annual report, Ghana's cashew in shell has an estimated unrealised potential of more than US$660 million. In 2020, Ghana exported around US$ 251.4 million in raw cashew in shell. Vietnam was the top destination for Ghanaian cashew nut exports in 2020, accounting for more than half (58.34%) of all cashew nut exports to the world. From 2016 to 2020, the Vietnamese market increased the value of Ghanaian cashew by 17%. In 2020, India was Ghana's second largest export destination for cashew nuts in shell (41.41%). China was the third largest importer of cashew nuts in shell. After Côte d'Ivoire and Cambodia, Ghana was the third largest supplier to Vietnam in 2020.

Globally, import value of in-shell cashews declined averagely by -5% per annum from 2016 to 2020 from US$ 2.856 bn in 2019 to US$2.594 bn in 2020. The only two countries that received significant amounts of cashew nuts in shell from Ghana are Vietnam and India. In both markets, Ghana is an important supplier, but there is room for growth.

Figure 3: Total Exports of Cashew Nuts (MT) and Value ($), 2011 -2020

More than 200,000 farmers are estimated to be directly engaged in cashew cultivating 234,171 ha producing about 230,000MT of RCN during the 2022/2023 season. They generate a chain of ancillary employment for about 200,000 people who work as buying agents, dealers, transporters, retailers, etc.

Cashew is grown as a smallholder crop in Ghana, and the commercial plantation sector is very small. It is estimated that about 88% of cashew farms are owned by smallholders, with farms ranging in size from a minimum of 0.8 ha to 3.0 ha.

Large plantations account for 12% of cashew farms and are sized between 4 ha to 40 ha. Most of these producers rely on family labour or hired labour, especially for weeding and harvesting activities. Since cashew is harvested during the lean season for all major staples (e.g. maize, yam, plantain, and millet), this crop can provide additional income for food purchases and contribute to increased food security.

___

Value Chain Mapping and Key Actors

Value Chain Actors and Service Providers

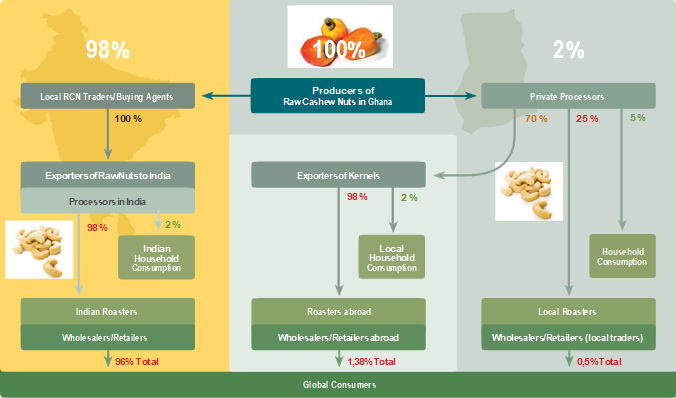

The Cashew Value Chain Map and the above pictorial representation of the cashew value chain depict a number of interrelated functions, actors and service providers who together define its nature and flow channels. These include the supply of inputs, production, collection, processing, and export. Several functional links and interrelationships can be identified by which cashew nuts and kernels flow from the producers through traders and processors to the domestic and international markets.

Input Suppliers

Provide producers/farmers with specific inputs such as seedlings, pesticides, herbicides, fertilisers, processing equipment and packaging materials. Seed dealers or nursery operators are found only in a few cashew producing areas. Some big agro-chemical dealers are located in Greater Accra (Dizengoff, Agrimat, Chemico, Aglow, Kurama Co. Ltd etc), while smaller dealers operate throughout the country. They sometimes offer information on the use of chemicals to producers.

Farmers or Producers

Production is mostly carried out by smallholder farmers, who are usually organized into associations. There are also a number of large cashew nut plantation owners, some of which leave their plantations idle or operate at a minimum level of efficiency looking at the cashew nut plantation as an investment in the future. Most of these producers rely on family labour or hired labour, especially for weeding and harvesting activities. It is estimated that there are 200,000 farmers with 234,171Ha of cashew farms and producing about 200,000 tons of RCN as at 2021/2022 season.

Processors

Value addition to cashews is mainly realised at the processing and packaging stage. There are different steps for processing cashews, mostly carried out by different actors and, again, mostly outside of Ghana. As for RCN originating from Ghana, the vast majority are exported to India and Vietnam, where they are converted into plain kernels which are then exported in bulk to markets in developed and emerging countries. There, further processing takes place with regard to roasting, salting/seasoning, packaging, and labelling/branding. Some major cashew processing companies include Kona Agro-processing, Nasaka Processing and Muskaan Ghana Ltd USIBRAS Ghana Ltd and Mim Cashew and Agricultural Products Ltd.

Distributors/Buying Agents

These include local traders, intermediaries, (agents), retailers and exporters. There are nine local RCN buyers, plus the four foreign companies in operation during the 2008 harvesting season. The agents of these companies purchase RCN by travelling from one marketing centre to another and sometimes travel to the farming communities themselves. Agents and traders are responsible for transporting cashews to ports and pay for the related costs. They sell RCN to exporters directly and, in some cases, to secondary intermediaries or middlemen.

Exporters

These are few in number and operate mostly from the Bono and Ahafo Regions, as well as from marketing centres in other cashew growing areas of Ghana. The RCN are collected in bulk and packed into jute sacks which are normally supplied by the traders/exporters. These are then transported to Tema harbour, where they are shipped to target markets such as India and Vietnam. Notable exporters in the industry include Olam Ghana Ltd, Evergreen Dakou, Ghana Nuts, Export Trading Group (ETG), Bet Exports Ltd, Blossom Exports Ltd, Mim Cashew Products, Rals Commodities Ltd, Ghana National Procurement Authority (GNPA) and Sri Amanan Ghana Ltd.

Consumers

Most consumers buy locally roasted kernels from supermarkets and other outlets.

Other Service Providers

Service providers include the Research, Extension services, Bulkers/transporters, NGOs and Financial Institutions.

Research

The Cocoa Research Institute of Ghana (CRIG) at Tafo as well as various University Institutions in Ghana support development of appropriate technologies for production and processing cashew value chains; however, they are facing financial and technical resources.

Extension Services

The Ministry of Food and Agriculture is mandated to offer extension services to all the actors in the cashew value chain. Sometimes in collaboration with NGOs and Donors, provide services through training, farmer field schools, and media releases.

Haulers/Transporters

Their main function is to transport RCN from the production centres to Tema. In case of processed cashew nuts (i.e. unroasted and roasted kernels), they would also transport from processing plants to the local markets and to the ports.

NGOs

Several Non-Governmental Organisations (NGOs) are active in the agricultural sector, and in cashew production and marketing in particular. These organisations provide extension services, training for farmers and cashew processors, and limited credit services.

Financial Institutions

They play a substantial role in the chain. With Government guarantee, Ghana EXIM Bank (previously EDAIF) been providing credits to farmers for the production of cashew. Processors also require loans for procuring raw materials and capital investments but access to financial products has been reported rather difficult.

___

Key Agronomic Practices

Key Good Agronomic Practices and their Importance

| Good Agricultural Practice | Brief Description and Importance |

|---|---|

| Planting Material | Locally developed types from CRIG-Bole station and Wenchi Agric. Station include BE 079, BE 107, Tan II 393, Tan II 209, SG 185, SG 266, SG 276 and SG 265. Six other dwarf varieties introduced from Brazil: CP 1001,76, 09, 06, 50, 51, which are available at Dawadawa Farms. |

| Nursery Establishment | Graft nurseries can be established with supervision from MoFA or sourcing from CRIG. |

| Land Preparation | Clear land with zero burnings while digging trenches and clearing natural waterways. |

| Planting | Plant improved seedlings in deep, fertile and well-drained soils. Fill 50cm holes with organic matter and topsoil before planting. Mulch seedlings after transplanting. |

| Choose suitable soils | Deep fertile and well-drained loamy soils. |

| Agro Climate Conditions | Sunny areas with rainfall amount between 890mm and 3,084 mm Temperatures between 20 oC - 34 oC. |

| Pruning | Prune unwanted and diseased branches to increase flowering and fruiting. |

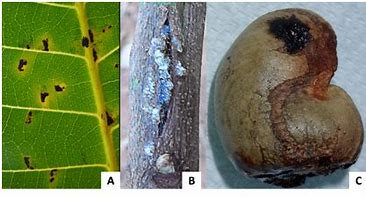

| Pests and Diseases Management | Use appropriate pesticides, thinning and pruning to control sucking pests, stem borers and anthracnose (Colletotrichum sp). Bacterial leaf spot disease is a big challenge in Ghana. Combine good sanitary measures, pruning, harvesting and application of pesticides to control it. |

| Soil Fertility Management | Apply organic manure (animal droppings) at planting time and under the base of trees to improve soil fertility and release of macro and micronutrients to the tree. |

| Weed Management | Clear weeds at shorter frequencies when trees are young. Use herbicides for matured trees to reduce competition for nutrients and water. |

| Harvest Management |

|

| Post-Harvest practices | Separate Raw Cashew Nuts from apple with twine and dry RCN in the sun. Store properly to prevent mould and decay in jute sacks at moisture content of 8-10% under 1 year. Cashews are cleaned to eliminate impurities brought from the field that may contaminate raw materials and result in problems related to equipment wearing out during the process. |

___

Key Risks Associated with Cashew Value Chain

Key Risks Along the Value Chain and Mitigation Measures

| Value Chain Actions | Key Risks and Challenges | Mitigation Measures |

|---|---|---|

| Input Supply | Land acquisition and tenure: Limited access to land for long term, large scale commercial farming is a hindrance to commercial production. | MoFA should lead a discussion on land tenure issues in cashew growing areas with all stakeholders. Demarcate and make available land banks for cashew farming. |

Nursery and Planting Material: Availability and access to high yielding and disease-free planting material is also a big challenge. There is high mortality when rains delay or is erratic. | Cocoa Research Institute of Ghana in Bole, MoFA and private operators should invest in nurseries and production of vigorous cashew seedlings that are disease-free and training of private nurseries operators. Invest in technologies that allow seedlings to withstand drought when transplanted including irrigation. | |

| Cost of and access to Fertilizer and Pesticides (Fungicides, Insecticides): Compound fertilizers and recommended pesticides for improving soil fertility and controlling cashew pest are costly and most farmers do not use it or tend to result to using smaller portions. The proliferation of fake pesticides in the market is also a big challenge. | Cashew Farmer Groups and Associations should bulk buy fertilizer and pesticides at a discount for members. Government through the Environmental Protection Agency (EPA) should enforce the laws on the use of fake pesticides and collaborate with Africa Cashew Alliance to train more extension staff and farmers. | |

| Finance | Inadequate Access to Financial Capital: Cashew farmers and agents have complained over the years about the lack of credit for farm maintenance and expansion. | Financial Institutions need to train credit officers on cashew farming and the value chain and where opportunities exist. |

| Production | Farm Maintenance and practices Diseases and Pests: Risk of insect sucking pest infestation such as Helopetis Sp, Anoplocnemis, stem borers (Apate telebrands) and anthracnose. Weeds compete with young cashew trees for nutrients and water. Very low yields due to non-adherence to Good Agricultural Practices (GAPs). | Improve extension delivery in the application of GAP, set up demonstration farms and support farmers to access spraying machines. |

| Low application of technology and insufficient technical knowledge in production and farm management limit growth. Adaptation of modern technologies and innovations is generally low in the cashew industry. | Government and cashew stakeholders should invest in training on GAPs and adopt best practices and innovative ideas from India and East African countries. | |

Climate/weather: The uncertainties in the climate situation – excessive rains, long spell of dry weather, high temperatures and humidity adversely affect production. Bush burning has been a bane over the years with young men looking for meat by hunting for bush animals. A long spell of drought and bush fires are perennial problems faced by farmers and the sector. | Invest in irrigation to provide adequate water. The government should enforce the policy on illegal mining (galamsey) and logging. Practice ring weeding and create fire belt. | |

| Post-harvest handling | Post-harvest management: Post-harvest losses due to pest infestation and diseases accounts for about 20% of losses while rot and inefficient shelling processes also result in more broken kernels. | Ensure training is widespread and build incentives for good quality flavour. |

| Marketing | Price Instability: Cashew prices have not been stable and lower demand and over production has often led to lower prices for farmers serving as a disincentive for farmers to invest in their farms. Unregulated pricing of RCN has impacted the supply of cashew to the processors, subsequently causing companies to go out of business. | Set up Cashew Board under MoFA to regulate the sector and improve the technology for storing RCN. The Ghana Tree Crop Development Authority should actualize this dream. |

| Processing | Percent of Raw Cashew Nuts processed locally (throughput) has increased over the years but consumption remains low and ready market for roasted kernels is a challenge as most Ghanaians prefer other nuts. | Promote the consumption of cashew products through campaigns. |

| High Interest Rates charged by financial institutions on loans and overdrafts are said to be one of the major factors negatively impacting processing. Also, the lack of working capital prevents the expansion of processing companies. | Design special products for tree crops such as cashew. Spread the payback period and allow more years for a moratorium. | |

| Inadequate Skilled Labour: The cashew industry relies heavily on manual labour, and scarcity of labour is continuously affecting the production capacity of cashew processors. Workers for rather labour-intensive processing are not available sufficiently and continuously throughout the year. Processing competes with other sectors where the pay is better or with seasonal farm activities that are important for the food security of the family. | Introduce labour-saving technologies and mechanization and improve incentives for workers including crackers and other workers involved in processing. | |

| Low investment in value addition: Availability of adequate RCN, high prices compared during peak demand, cost of equipment and low skilled labour are some of the major constraints faced by existing and potential processors. | Set up a good nucleus and out-grower schemes under contract farming that assures processors of regular supply at agreed prices. Train more women on processing kernels. | |

| Inadequate Logistics and Infrastructure: Inadequate transportation facilities and distribution logistics add to processing costs. | Provide incentives and remove bottlenecks including improvements on roads and logistical support for exporters and processors. | |

| Consumption | Low internal consumption of cashew products in Ghana and Africa, Lack of aggressive promotion of the consumption of cashew and other products. | Hold promotional campaigns and work to reduce the price of roasted and unroasted kernels and other cashew-based products so more people can buy. |

| Other | Inadequate resources to support research along the production and processing stages. Weak extension support- high ratio of farmers to extension officer. | Provide adequate resources to Cocoa Research Institute of Ghana and push private cashew companies to invest a percentage of their money in research in Ghana. |

| Exchange rate fluctuation affects pricing and cost of inputs and processing thereby affecting margins and resulting in price competitiveness with imports. | Stabilise the exchange rate. |

___

Pests & Diseases that Affect Cashew

Major Pests and Diseases of Cashew and their Control Measures

| Pests/ Diseases | Symptoms | Management/Control Measures |

Anthracnose  |

|

|

Anoplocnemis  |

|

|

Bacterial Leaf Spot  |

|

|

Helopeltis sp  |

|

|

Stem bore  |

|

|

___

Market Information

Cashew is currently Ghana’s leading agricultural non-traditional export (NTE), bringing in about US$294.2 million worth of export revenue in 2022 from US$287.5 million representing growth of 2.34 percent.

There is an estimated demand gap of over 2 million metric tonnes of cashews on the international market toward which Ghana can contribute. The marketing channel comprises producers, village merchants or agents, exporters, local processors, and supermarkets.

In Ghana, we have a domestic and export market for cashew. The local market is dominated by local village agents and merchants who purchase cashew at an agreed price based on demand and supply situation, bulk and resell to exporters and to local processors. Raw Cashew Nut (RCN) processors are buying nuts from small and medium-scale farmers, brokers and agents. Locally established RCN export continues to compete with the processors for the limited supply of RCN.

The export market is dominated by traders who buy RCN or kernels and export to India or Vietnam. Over 95% of locally produced cashew nuts are traded as RCN exports, and the remainder is sold to local processors for conversion into kernels mainly targeting the export market. Only about 10% of the kernels produced are sold on the local market, implying that about 99% of all cashews grown in Ghana are exported either as RCN or as kernels.

Three main cashew products are traded on the international market: raw nuts, cashew kernels and cashew nut shell liquid (CNSL). A fourth product, the cashew apple is generally processed into juice, wine, fermented into vinegar and consumed locally as fresh fruit and for medicinal purposes.

Cashew Marketing Chain

Demand and Supply

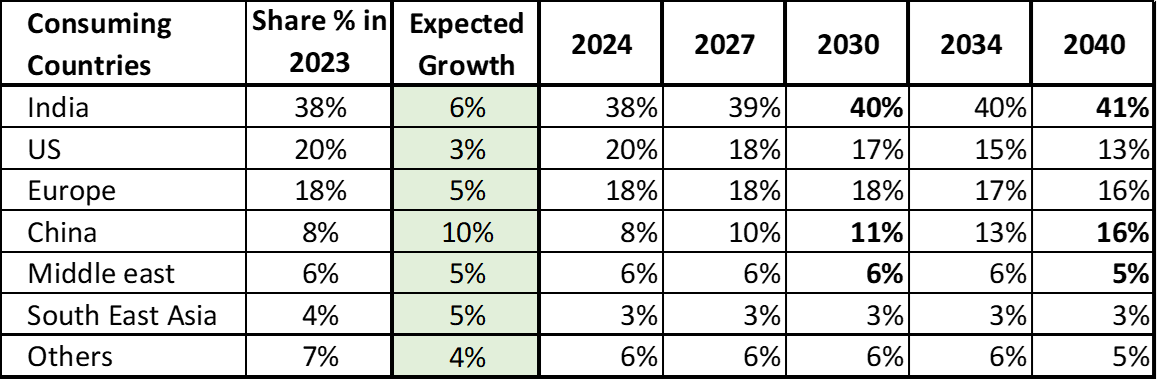

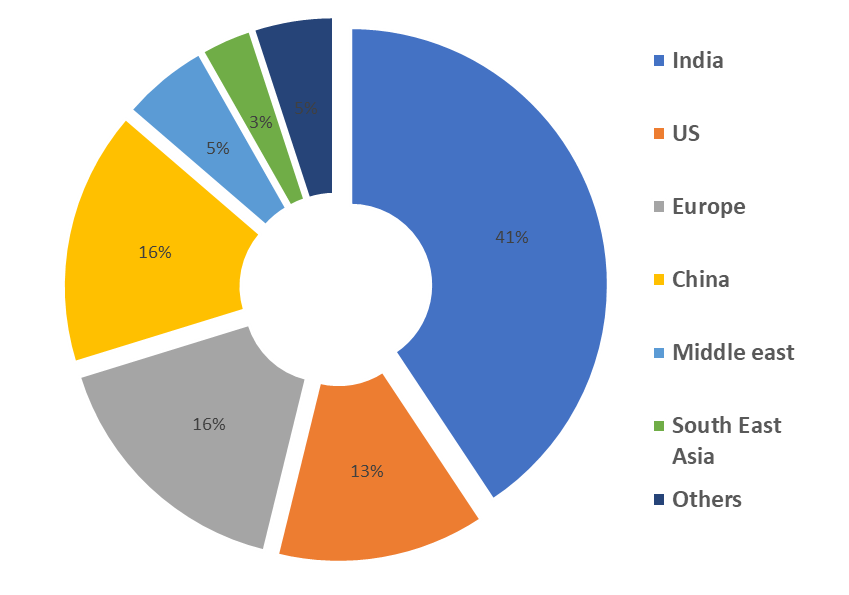

India will remain the biggest market for cashews in next decades. It is projected that India alone will consume 41% of cashew produced globally in 2040 from 38% in 2023 at 6% growth over the period.

It is projected that by 2040;

- Vietnam and Cambodia production will serve Chinese, Asian and some other markets ~ 22-23%

- Africa will produce ~ 58% of RCN by 2040.

- Available potential kernel markets is India (sell ~36% kernels)

- Africa expected to create local markets ~3-4% by 2040

- India would need ~1.7 million Mt of RCN or equivalent in kernels from Africa. (to consume)

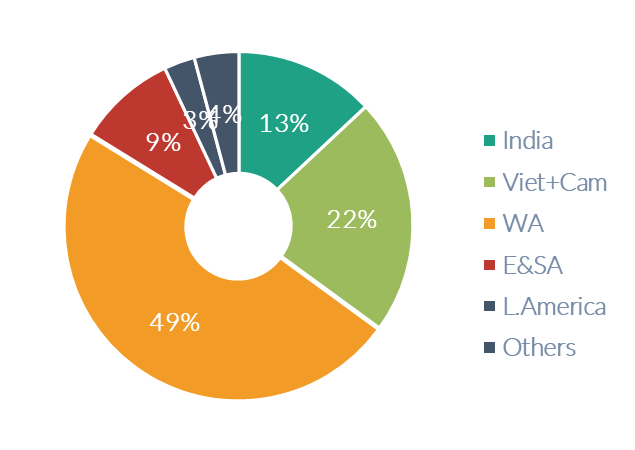

In terms of supply, it is estimated that 49% of RCN will be supplied by West Africa in 2040 followed by Vietnam and Cambodia, with combined production of 22%, then India 13% etc.

RCN Production estimates 2040

Raw Cashew Nut Production Vs Consumption

Raw Cashew Nut Supply Chain

Price Trends

The price of RCN has not been stable and experienced fluctuations over the years due to demand and other factors such as the weather. The average farm-gate price in 2019 was around GH¢ 8 per kg but dropped to GH¢ 3 – 5 per kg in 2020 because of the novel coronavirus pandemic. There is no guaranteed fixed price for cashew. The normal price range in 2022 was between GH¢ 4.5 - 7.5 per kg with FOB Tema Price of RCN at $1250-1,500 per tonne.

A small proportion (less than 5%) of the cashew kernel sold on the local retail market is packaged in small packs of 50 gm to 500 gm as white roasted or salted. A major outlet of these packs are city and highway hawkers. While this sector seems to be growing

Quality Issues, Certification, and Standards

Cashew competes in the same market with other edible nuts including almonds, hazels, walnuts, pecans, macadamias, pistachios and peanuts. There has recently been a considerable rise in demand for edible nuts by consumers interested in quality and health aspects of food.

The quality of Ghana cashew nuts is usually good (more than 90% are sold as Grade A). However, hygienic standards pose a challenge, particularly to small and medium processors.

The quality of cashew nuts is determined by size, shape, weight, external appearance (disease, spotted, shrivelled), acceptable moisture content (not exceeding 10%) and kernel quality. The kernel quality includes colour, size (related to grade), shape (whole or broken) and peel ability of testa. Improving the nut quality is key to raising smallholder incomes and enhancing the competitiveness of the Ghanaian cashew industry. Depending on the shape, size and colour of the kernels, cashew kernels are graded differently. The important factors of grading are colour, shape and size of the cashew kernel.

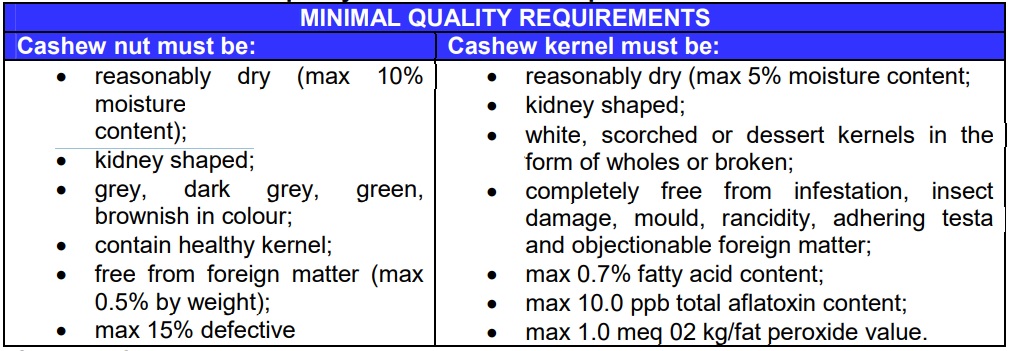

Table 1 provides a summary of the minimum quality standards for the export of cashew nuts and kernel.

Table 1 : Minimum Quality Standard for the Export of Cashew Nuts and Kernel

There are about 24 cashew grades but the most common ones are listed in Table 2 below. Each grade has a different price and W180 is the most expensive and not easily available in the market.

Table 2: Grades for Cashew Kernel

| Grade | Grade Number of kernels per lb (kg) |

| White wholes | |

| W180 (super large) | 120-180 (266-395) |

| W210 (large) | 200-210 (395-465) |

| W240 | 230-240 (485-530) |

| W280 | 270-280 (575-620) |

| W320 | 300-320 (660-706) |

| W450 | <300 (<660) |

| White pieces | |

| Butts | A kernel broken clearly across the section of the nut |

| Splits | A kernel which has broken down the natural line of cleavage to form a cotyledon |

| Pieces | A kernel which has broken across the section but does not qualify for a butt and is above a specific size. |

| Small pieces | As above but smaller |

| Baby bits | Very small pieces of kernel which are white colour |

| Scorched grades | |

| Wholes | Whole kernels that have been slightly scorched during the process but are otherwise sound. These are not graded according to size. |

| Butts | Butts that have been scorched |

| Splits | Splits that have been scorched. |

| Pieces | As for pieces, but which have been scorched during processing and contain all but the very small pieces. |

| Tree Crops Policy 2012 | |

Investment Opportunities

There are many investment opportunities in the cashew industry that must be explored along the value chain. Apart from cultivating cashew as a farmer, there are opportunities for investing in the collection, assembling, and reselling RCNs to exporters.

Over the past 10 to 15 years, many local processing firms have been established in addition to Kona, Mim, Nasaka etc. Processing cashew into kernels and other products is laborious but rewarding.

Setting up a roasting business and repackaging into ready to eat salted kernels is another area. Compared with other nuts, cashew is not very popular with Ghanaians, but consumption is increasing as more people frequent shopping malls and supermarkets. There has to be an aggressive campaign to educate Ghanaians on the nutritional benefits of cashew and once the price is reasonable, many in the middle class will start buying and opportunities will increase for investors.

CASHEW NUT IN-SHELL – POTENTIAL MARKET REPORT 2020

https://www.gepaghana.org/market-report/cashew-nut-in-shell-potential-market-report-2020/

Links to Resources

- Implementation Plan for Cashews based on Cashew Master Plan – Chapter 3 on Cashew

- A Value Chain Analysis of the Cashew Sector in Ghana African Cashew Initiative, 2010

- A Guide to Cashew Production, Directorate of Crop Service, MoFA, 2017

___

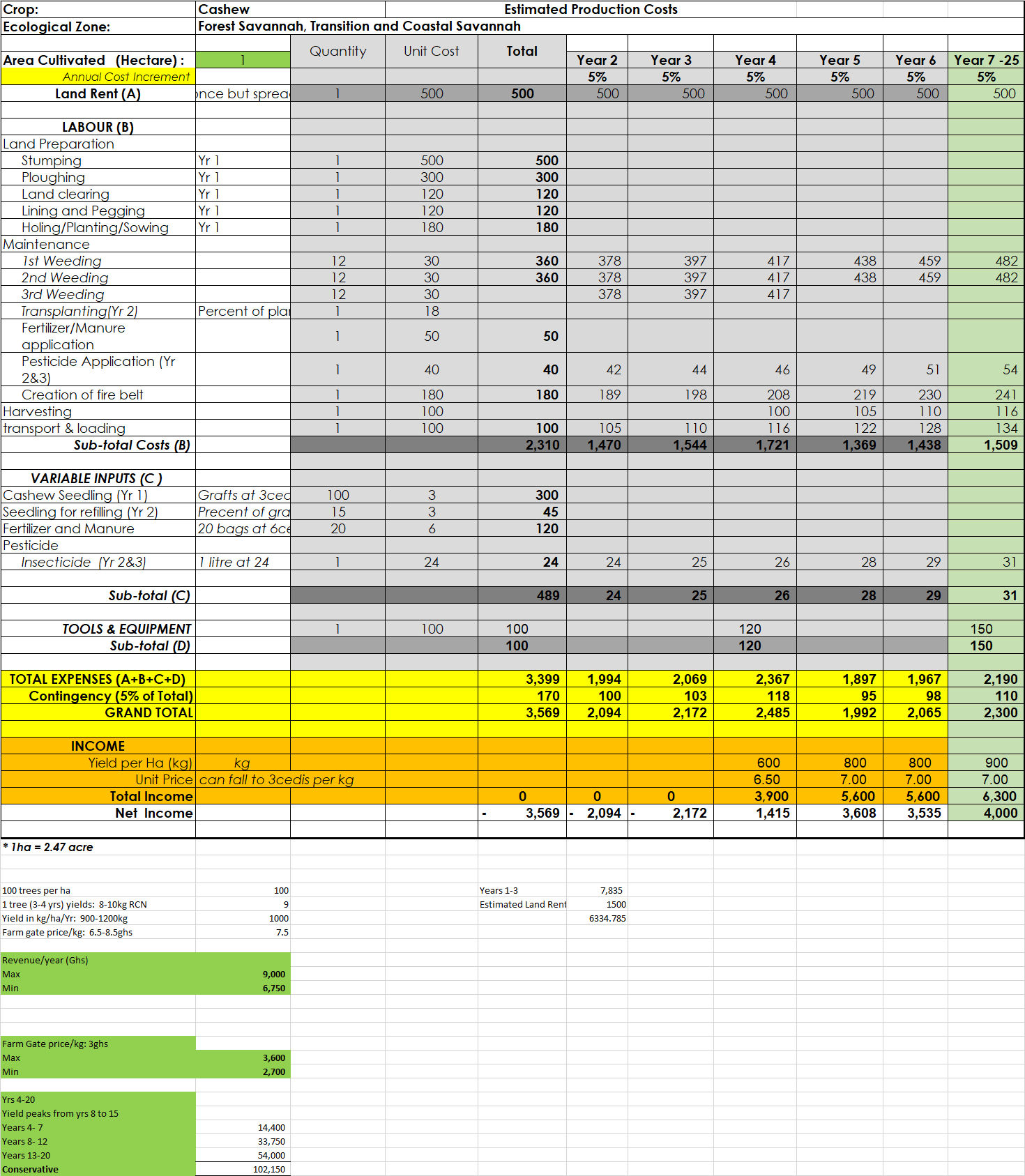

Enterprise Budget for Cashew

Cashew Budget and Cashflow

___

Policy Environment and Regulations

| No: | Name of the Project/ Project component | Duration | Area of Intervention (Geographic | Outputs/Activities |

| 1. | Cashew Development Project (CDP) | 2000 -September 2010 | 6 districts -Brong Ahafo, 5 districts -Northern Region, 2 - Upper West, 2 - Volta Region 2 - Greater | Processing, Marketing, Research & Extension, Credit provision, Local improvements |

| 2. | Afram Plains Agricultural Development Project | Project ended in 2012 | Kwahu North District | Production and Marketing |

| 3. | Trade and Investment Program for a Competitive Export Economy (TIPCEE) | Project ended in December 2009 | Operates in all cashew growing districts | Training (technical- and business management-related), Farm Mapping, Technical Back stopping Marketing |

| 4 | Adventist Development and Relief Agency (ADRA) | 1997-2002 | Districts in Brong-Ahafo | Training, Farm Mapping, Technical Back stopping. |

| 5. | Ricerca e Cooperazione (R & C) | Project has ended | Kwahu North District | Production and Marketing |

| 6. | African Cashew Alliance (ACA) | Cashew growing districts | Established in 2006 | Promotion of African cashews in regional and global markets |

| 7. | West African Trade Hub (WATH) | Cashew growing districts | 2019 - 2024 | Trade Development Services |

Government through MoFA implemented the Cashew Development Project for over six years from 2001 with funding from the Africa Development Fund. The project supported farmers to cultivate more cashew, increased incomes and supported the internal processing of cashews for local consumption. Government agencies and departments including the Department of Cooperatives and Crop Services mobilized farmers into groups for training and capacity building. Cocoa Research Institute of Ghana (CRIG) has a research centre in Bole and has been supporting with varieties and agronomic practices. The former Export Development and Agricultural Investment Fund (EDAIF), an agency of MoTI supported cashew financing over some period with soft loans and grants.

MoFA managed the Cashew Development Project (CDP) with funding from the African Development Fund (ADF). The project focused on production agronomy, providing technical assistance to processors, and gathering quality data for industry players and to inform policy.

The Government of Ghana is in the process of setting up the Tree Crop Development Authority under an Act of Parliament. The Tree Crop Authority’s focus is to regulate the management, production, processing, and trading in tree crops such as cashew, oil palm, shea and rubber. There is a provision to allow future inclusion of other tree crops. Government is in the process of appointing the Board of Directors and management to operationalise the Authority’s activities.

The Cashew Producer Associations, African Cashew Initiative (ACi), African Cashew Alliance (ACA), Solidaridad, TechnoServe, ADRA are some of the programmes, NGOs and groups that supported cashew production in the past and/or are now providing technical assistance, capacity building and financial assistance to farmers. They are supported by donors including USAID, GIZ (ACi), BMZ, Bill and Melinda Gates Foundation. Some of the associations include the Ghana Cashew Industry Association (GCIA), CAPEAG, Ghana Cashew Producer Associations in Wenchi and Bole.

Private sector players and processing firms include Mim Cashew Products, Kona Agro-processing, Winker Investments, Nasaka Processing and Muskaan Ghana Ltd based at Nsawkaw, Rajkumar Implex, Hualian Int. Co. Ltd and Innovative Thinking.

Financial institutions supporting the cashew industry include Unibank, Stanbic, Bank of Africa, and Fidelity tend to focus on clients engaged in the trading, processing, and exporting of cashew nuts. Agricultural Development Bank (ADB) and rural banks support RCN production.

___

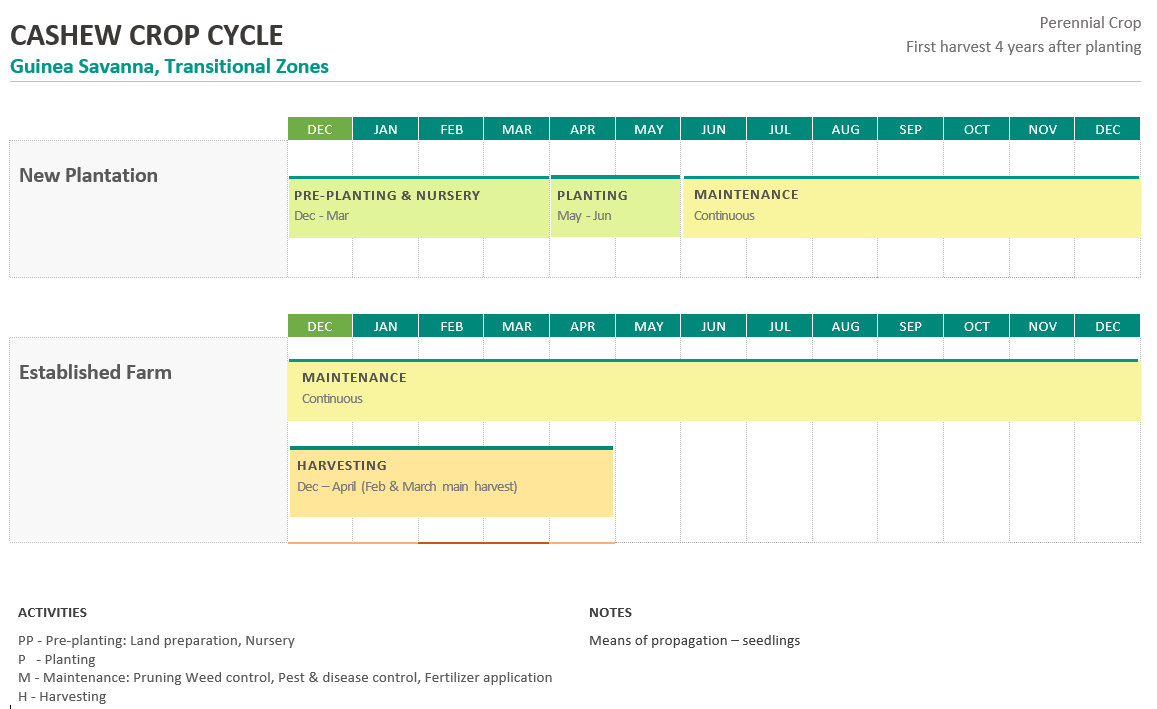

Cashew Growing Seasons and Cropping Cycle

___

Cashew Processing

Cashew processing is still an infant industry in Ghana with local installed capacity exceeding the net RCN production left for processing after raw RCN exports. Locally established RCN export competes with local processors for the limited supply of RCN. Ghana is likely to be a net importer of nuts just to feed the processing industry if RCN production is not increased to meet demand.

There are over twelve (12) large and small-scale processing companies in the country, with over 27,000 mt installed processing capacity, 88 percent of the nation's installed capacity is located in the Bono and Ahafo Regions. The top brands in this area include Mim Cashew Products, Kona Agro-Processing Ltd, and Cash Nut Foods Ltd. The total processing capacity has increased to more than 60,000 mt as a result of the inclusion of Usibras in 2014, Brazil's largest processor, with its 35,000 mt plant.

Less than 5% is processed into the kernel and more than 95% exported as Raw Cashew Nut (RCN) to mainly India (90%) and Vietnam (10%).

In the last years, several medium and large-scale processing facilities have been built in Ghana. Investment in processing is expected to have a strong impact on the local market and drive production and prices to higher levels.

In Ghana, cashew processing is a manual process performed largely by women. Some of the main products of processed cashew include cashew kernels (roasted and unroasted); plain kernels after roasting, white whole nuts when kernels are processed; processed apples (give alcoholic and non-alcoholic drinks, e.g. cashew gin); livestock and poultry feed (from apple pulp); biogas generation (from cashew shells); and brisquettes (from Cashew nutshell liquid (CNSL) – known to lower cholesterol and control diabetes). Nut processors use about 5.37 kg raw nuts to produce one (1) kilogram of kernels.

Generally, cashew kernel yields range from about 20 to 24%. Thus, one metric tonne of raw cashew nuts can yield between 200 and 240 kg of edible kernel wholes and pieces after processing.

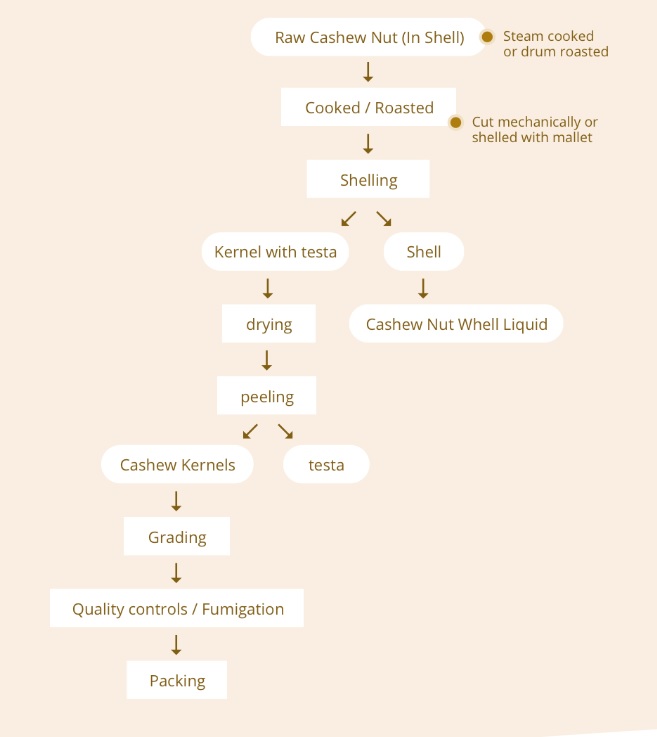

The flow chart below gives an overview of the steps involved in processing cashew nuts but does not include many of the additional steps shellers and processors may undertake.

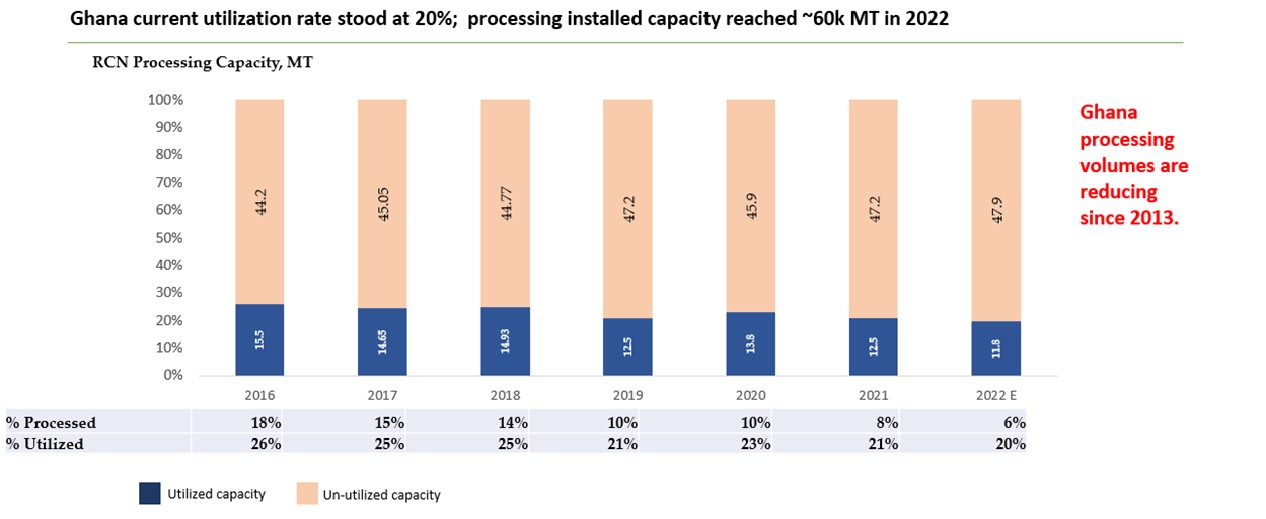

Ghana has approximately 60,000 mt installed processing capacity as of 2022. Ghanaian processors are operating below installed capacity due to myriads of problems, chiefly among the causes include low gross margins, high cost of utility, inadequate financing etc.

Ghana utilized 20% of its installed processing capacity from 26% in 2016. As at 2022, Ghana processed only 6% of RCN produced locally. Percentage of processed RCN continues to dwindle reduced from 26% in 2016 to 6% in 2022.

___

Agriculture in Africa Media LBG | Email: Ghana@agricinafrica.com

Comments

Post a Comment