General Overview of Coffee Industry

Introduction and Background

Coffee (Coffea) is the major genus of the Rubiaceae family, which includes well over 500 genera and over 6,000 species. The genus Cofea comprises numerous species. Only two species, commonly known as Arabica and Robusta (Canephora), are of real commercial importance and account for the majority of coffee consumed worldwide. Due to its responsiveness to varying climatic conditions, the robusta is the most favourable for the West African sub region and more especially Ghana.

Robusta is grown at lower altitudes and is hardier. It typically yields lower quality, much of which is used to produce soluble coffee. Generally, the world’s biggest Robusta buyers are major roasters and manufacturers. It is used in a variety of caffeinated products, including capsules, blends and energy drinks.

Robusta producers have been experimenting with quality development, achieving some significant results in improving the cup profile. Easier and less expensive to grow in a warm climate and more resilient to pests, diseases and harsh environmental conditions. The Robusta could play a key role in meeting rising demand for coffee in a world increasingly threatened by climate change.

Coffee Production in Ghana: Historical perspective

Coffee cultivation in Ghana dates to the mid-eighteenth century when the early missionaries settled in Ghana.

The primary coffee plant varietal historically grown in Ghana is Robusta which is considered to be a lower grade coffee than Arabica. This is likely to be a persistent problem, as even at the highest points Ghana only reaches about 400 meters above sea level - well below the 1,200+ meters required for the best Arabica coffees to be grown. Robusta coffees however, will flourish at the lower elevations.

Countrywide surveys taken in the period 1970-1980 showed that the area under coffee cultivation was 13,346 ha. This was reduced -to about 3,170 ha as of 1985 by severe drought and bush fires in the early 1980. Production therefore reduced from 6,700 tonnes in 1967/68 to a low of 123 tonnes in 1983/84.

The coffee sector consistently recorded small volumes mainly due to the limited attention it received. However, the sector experienced a major boost in 1991 through the Agricultural Diversification Project (ADP) to revamp the coffee industry. The ADP through interventions such as planting material support, liberalized markets and improved research and extension expanded area under cultivation to 8,723 ha with corresponding increase in production to 5,700 tonnes in 1999. These gains were short-lived due to non-existent formalized pricing regime, to absorb the shock from the decline of the international market commodity price which led to the breakdown of the internal marketing system. Farmers’ interest in coffee production therefore weaned down and this caused farmers to diversify their farms into other tree crops and off farm activities. This led to the disruption of many household economic stability and social interaction in the various coffee producing communities.

Following the many calls by the various actors in the coffee industry, series of stakeholders’ consultations were held in 2008 to map out strategies to revive the coffee industry. This led to the roll out of the Coffee Rehabilitation Project (CRP) in 2011 which sought to increase coffee production for export and local consumption and enhance the livelihoods and standard of living among farmers in coffee growing communities in Ghana. With a budget of GHS4million, the CRP targeted to increase national production from 1,769 metric tonnes to 10,000 metric tonnes by 2015 and 20,000 metric tonnes by 2020. With these targets both old and abandoned coffee farms were rehabilitated while new farms were established by assisting beneficiary farmers with various inputs in kind and in cash, free planting materials and efficient extension services.

With an estimated production level of 12,650 tonnes at the end of 2015, the average productivity was over 1.5 tonnes per hectare. The project recorded farm gate prices increased from GHȼ35 per 64kg per bag in 2011 of unhulled coffee to GHȼ270 per 64kg per bag in 2016. Currently, the 2022 farmgate price of the clean green coffee is estimated between GHS688 and GHS938 per 64kg.

Key challenges identified included weak institutional support, poor marketing, unregulated and unstructured sector and weak research and extension support. However, favourable weather, high economic returns and growing interest towards production and consumption presents great opportunities for the development of the sector.

Share of GDP

The contribution of the Coffee sector to Ghana’s GDP moved from 0.01% in 2010 to 0.12% in 2015 as depicted in the table below. This represents an increase of 1,100% between 2009 and 2015.

Table 9: Coffee share of Ghana’s GDP | ||

Year | GDP (GHȻ million) | Share of GDP (%) |

2009 | 36,597.59 | 0.01 |

2010 | 46,042.10 | 0.01 |

2011 | 59,816.32 | 0.02 |

2012 | 75,315.37 | 0.12 |

2013 | 93,415.89 | 0.09 |

2014 | 113,343.40 | 0.11 |

2015 | 139,935.86 | 0.12 |

Estimated Production, Producer Prices and Net FOB Import

Ghana’s coffee sector has recorded increases in values of FoB imports of 77% between 2010 and 2015 as against the reduction of 69% in value of Export as depicted in table below. The increase in imports reflecting increasing demand for coffee products and its derivatives alongside the evidence could account for the current trend of exporters selling locally.

Further to this, the indicative price of 64kg unhulled coffee increased within the same period by 62.16%. On the other hand, real farm gate prices increased by 127.05%.

Production, Pricing and Exports Values | |||||

| Crop year | Volume | Indicative farm gate prices (US$) | Average Real farm gate prices (US$) | FOB Import (US$ million) | FOB Export (US$ million) |

2010 | 4,082 | 25.00 | 35.71 | 574,534.22 | 1,999,269.37 |

2011 | 9,035 | 26.67 | 50.00 | 1,565,211.45 | 8,875,179.79 |

2012 | 48,517 | 30.56 | 55.56 | 761,761.65 | 112,150,336.30 |

2013 | 43,931 | 37.50 | 75.00 | 670,327.38 | 3,916,283.26 |

2014 | 45,093 | 41.38 | 68.97 | 632,598.42 | 101,619.12 |

2015 | 42,230 | 40.54 | 81.08 | 1,014,422.88 | 628,597.39 |

Source: Ghana Statistical Service (2016) | |||||

However, it is estimated that in 2020, coffee import value stood at US$750,000 as against US$1,808,809 export value same year.

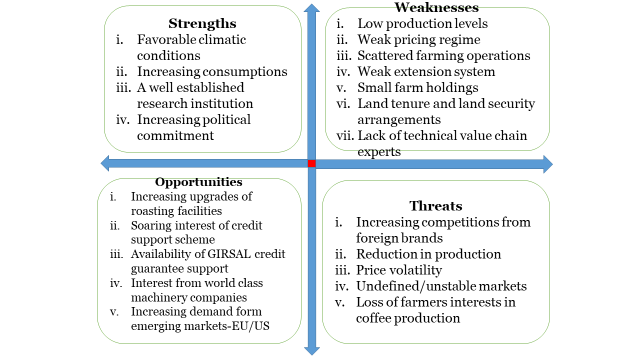

SWOT Analysis of Coffee Industry

Physiology of the Coffee Plant

The Robusta Coffee plants are perennial shrubs of an average of 10 meters high thrives in lower elevations. It has a prominent vertical stem with branches originating from exact opposite side of the stem. These branches which grows laterally also produced the secondary and tertiary flowers for the cropping cycle.

The coffee plant has oval shaped broad and thin but dark glossy leaves with conspicuous veins which grow on a petiole in opposite sides of the branches and sometimes on the stems.

The plant produces creamy-white clustered flowers which blossom in 6 days after the receipt. As a cross pollinated and self-sterile plant, the Robusta coffee has expanded bracts with flowers per inflorescence which takes 9-10 months to grow into an average of 50 berries per node. It can be propagated through seed or vegetatively. For a competitive coffee industry, it is highly recommended that the Robusta coffee is propagated exclusively through vegetative means.

The Berries

During the first 2 months, the pinheads develop slowly whiles the berries expand rapidly 3 month afterwards. Generally, it takes 8 – 9 months for the fruit (berries) to mature. Normally two seeds covered in a mucilage are developed within each matured berry. When ripe the skin is removed through pulping.

Production and Consumption

According to the Coffee Market Report October 2023, the estimates and outlook of production and consumption for coffee years 2021/22 and 2022/23 remain the same.

Production: World coffee production decreased by 1.4% to 168.5 million bags in coffee year 2021/22, hampered by the off-biennial production and negative meteorological conditions in a number of key origins. However, it is expected to bounce back by 1.7% to 171.3 million bags in 2022/23. Increased global fertiliser costs and adverse weather conditions are expected to partially offset the positive impact of biennial production from Brazil, explaining the relatively low rate of growth in coffee year 2022/23. The impact of biennial production is anticipated to drive the outlook for Arabica, which is projected to increase by 4.6% to 98.6 million bags in coffee year 2022/23, following a 7.2% decrease in the previous coffee year. Reflecting its cyclical output, Arabica’s share of the total coffee production is expected to increase to 57.5% from 55.9% in coffee year 2021/22. South America is and will remain the largest producer of coffee in the world, despite suffering from the largest drop in output for almost 20 years, which fell by 7.6% in coffee year 2021/22. The recovery in coffee year 2022/23, partly driven by biennial production, is expected to push the region’s output to 82.4 million bags, a rise of 6.2%.

Consumption: World coffee consumption increased by 4.2% to 175.6 million bags in coffee year 2021/22, following a 0.6% rise the previous year. Release of the pent-up demand built up during the COVID-19 years and sharp global economic growth of 6.0% in 2021 explains the sharp bounce back in coffee consumption in coffee year 2021/22. Decelerating world economic growth rates for 2022 and 2023, coupled with the dramatic rise in the cost of living, will have an impact on the coffee consumption for the year 2022/23. It is expected to grow, but at a decelerating rate of 1.7% to 178.5 million bags. The global deceleration is expected to come from non-producing countries, with Europe’s coffee consumption predicted to suffer the largest decrease among all regions, with growth rates falling to 0.1% in coffee year 2022/23 from a 6.0% expansion in coffee year 2021/22.

Balance: As a result, the world coffee market is expected to run another year of deficit, a shortfall of 7.3 million bags.

World Supply/Demand Balance

% change | |||||||

Coffee year commencing | 2017 | 2018 | 2019 | 2020 | 2021 | 2022* | 2022/21 |

PRODUCTION | 167,568 | 169,884 | 168,387 | 170,868 | 168,485 | 171,268 | 1.7% |

Arabica | 97,862 | 99,615 | 96,670 | 101,577 | 94,248 | 98,559 | 4.6% |

Robusta | 69,707 | 70,269 | 71,717 | 69,290 | 74,237 | 72,709 | -2.1% |

Africa | 17,428 | 18,523 | 18,698 | 19,281 | 19,132 | 19,405 | 1.4% |

Asia & Oceania | 52,214 | 48,069 | 49,307 | 47,912 | 52,102 | 49,713 | -4.6% |

Mexico & Central America | 21,475 | 21,361 | 19,321 | 19,747 | 19,655 | 19,726 | 0.4% |

South America | 76,453 | 81,934 | 81,064 | 83,937 | 77,596 | 82,424 | 6.2% |

CONSUMPTION | 165,637 | 170,876 | 167,593 | 168,569 | 175,605 | 178,534 | 1.7% |

Exporting countries | 51,575 | 52,234 | 51,441 | 52,518 | 53,615 | 55,369 | 3.3% |

Importing countries (Coffee Years) | 114,062 | 118,642 | 116,152 | 116,051 | 121,991 | 123,165 | 1.0% |

Africa | 11,707 | 11,921 | 12,034 | 12,552 | 12,877 | 13,403 | 4.1% |

Asia & Oceania | 38,819 | 39,572 | 39,198 | 41,289 | 42,828 | 44,162 | 3.1% |

Mexico & Central America | 5,667 | 5,805 | 5,857 | 5,882 | 5,967 | 6,124 | 2.6% |

Europe | 53,523 | 55,449 | 53,953 | 52,237 | 55,359 | 55,388 | 0.1% |

North America | 29,939 | 31,789 | 30,581 | 30,228 | 31,679 | 32,078 | 1.3% |

South America | 25,981 | 26,340 | 25,969 | 26,381 | 26,895 | 27,379 | 1.8% |

BALANCE | 1,932 | -992 | 794 | 2,298 | -7,120 | -7,266 | |

*preliminary estimates

___

Value Chain Mapping and Key Actors

Overview of the Coffee value chain

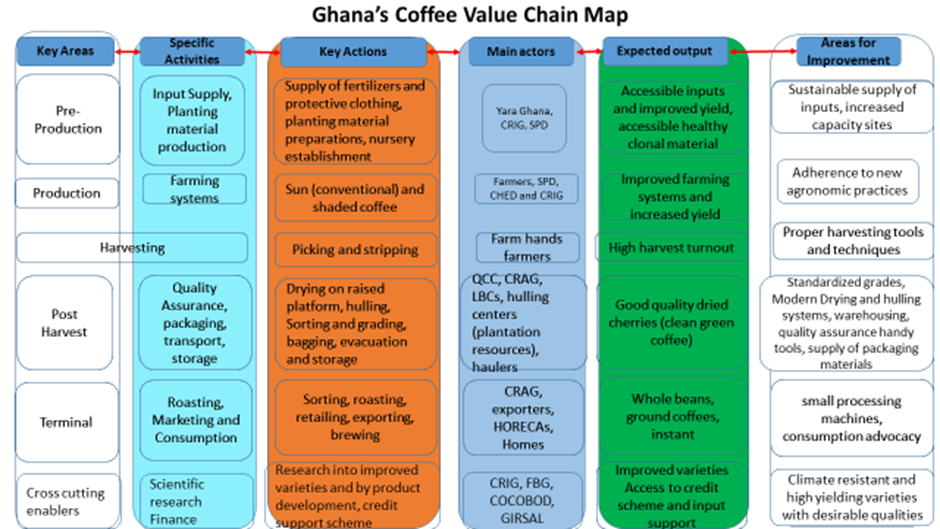

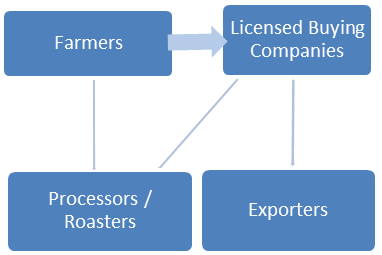

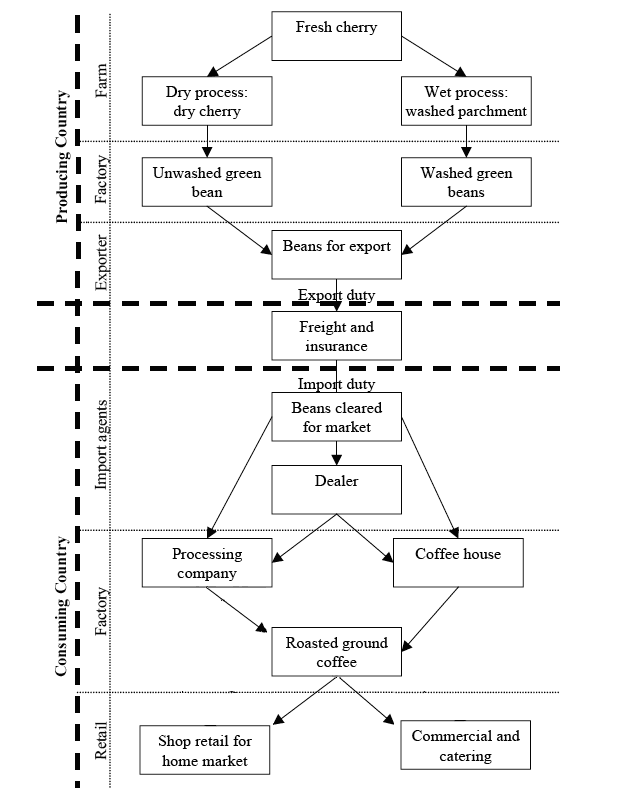

The Ghanaian coffee value chain covers the activities from input supply through harvest to roasting and consumption. This involves various actors either in national level or the international level. The major driving factors in the domestic market is the profit margin, value added practices and security of income, while at the international markets more emphasis is on the quality of the produce.

Description of the Value Chain

The coffee value chain is characterized by actors whose activities interrelate and dependency typified by their level of common interest. The Ghanaian Coffee value chain Map as in the Figure above describes the key activities with specific driving actions and the key players in each segment. It further explains the expected output from the interaction among the identified value chain actors. In addition, the mapping tries to bring out the key areas for improvement which basically implies areas for investment.

The map is divided into three categories as detailed in Table 1 below

| Categorization within the Ghanaian Coffee Value Chain | ||

| Category | Thematic description | Typical activities |

| Production | Preproduction, Production and Harvesting | On farm input supplies, Planting materials production, farming systems application, on farm production and management and harvesting |

| Post Production | Post-Harvest and Terminal activities | Postharvest processing, quality assurance, packaging, transport, storage and warehousing, roasting, marketing and consumption |

| Enabling contributors | Crosscutting | Research, Policies and Regulations, Financing and Project Management |

Input Supply

Key among the inputs supplied for on farm coffee production include planting materials (clones) fertilizers, agro-chemicals to prepare the soils such as nematicides and other safeguards such as wellington boots, protective coats, cutlasses, etc. and simple on farm tools such as slashers, cutlasses and sprayers. The major companies involved are in the supply of farm inputs include Yara Ghana, OmniFert, Desert lion, Chemico, etc.

Clonal Garden Establishment

One of the issues in the Ghanaian coffee sector has to do with type of planting materials supplied to the farmers. Currently Coffee farmers in Ghana do not buy coffee planting materials for production. Government through COCOBOD supplies to farmers for free. To ensure the sustainable production of good quality coffee, the Ghanaian robusta coffee is produced mainly from clonal materials obtained from clonal gardens established by Cocoa Research Institute of Ghana (CRIG). Sourcing such clonal materials from CRIG ensure the materials for propagation are true to type. Coupled with the technical nature and the complexities involved in the establishment, management and production of the Coffee clonal materials, CRIG continues to be the main institutions to source these materials for onward multiplication.

Clonal Material Production

Apart from the multiplication sites under CRIG, there is a close collaboration between Seed Production Division (SPD) of COCOBOD in the multiplication of the coffee clonal materials. This joint effort is to ensure planting materials are made as accessible as possible to the farmer and reduce the high losses recorded during the transportation of the clonal materials from the research station CRIG. Pursuant to that, coffee cuttings multiplication sites have been established by SPD in selected coffee growing areas. Receipts from CRIG are carefully nurtured until fully matured and ready for distribution to farmers after careful selection of superior ones. Thus, production is on limited basis but expected to pick over the next few years when the sites for multiplication are ready and come on board.

Expected output and areas for improvement in the pre-production phase

The interactions among the key actors identified in the pre-production phase, Input suppliers, CRIG and SPD, is expected to result in increased access to affordable farm inputs most especially fertilizer and termiticides and accessible elite planting materials. In addition, the actions in this phase should be translated into increased yield. To achieve this expectation, deliberate attention must be given to sustainable supply of on farm inputs and also commitment towards increasing the planting material production capacity of CRIG and also the multiplication centers by SPD.

Production

Farming system

Robusta coffees, which forms 30%-40% of the world’s coffee production, are the only coffee species produced in Ghana due to Ghana’s low altitude and all year round warm climatic conditions. Coffee produced in Ghana is generally called upland coffee because it is estimated that 60% of production occurs in the Volta and Eastern regions where majority of this cultivations are done on the mountains. These two areas are noted to produce coffee with superior qualities. These are mainly grown with significant number of shade trees with an average of 16 trees per hectare as recommended.

Farm Holdings

Most farmers produce coffee alongside other food crops such as plantain, cassava and yam with average farm size of 12 acres. However, there are individual farmers in the Kwahu Traditional Area with an average of 31 acres. Monocrop coffee farming is only found on the large estates owned by the Planation Resources Limited in the Bono and Western North regions as well as Ghalia Ghana plantation in the Eastern region.

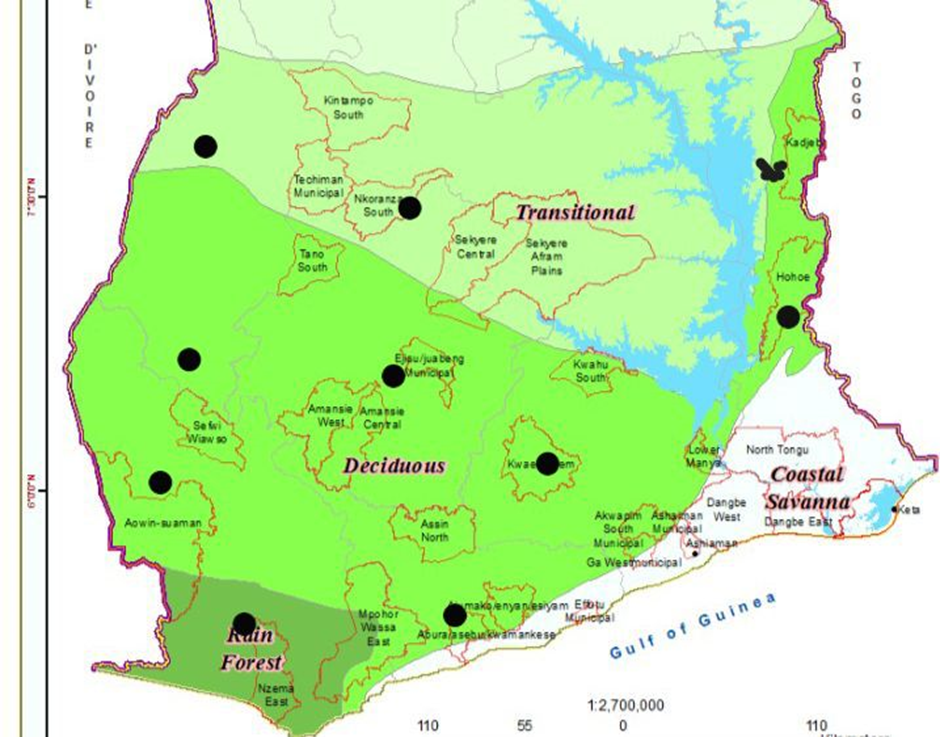

Areas of production

Coffee is mainly cultivated in the forest ecological zone. Ghana Statistical Service (2014) reveals that there are about 8,164 households that harvest coffee in Ghana with about 7,079 representing the forest ecological zone where coffee is predominantly harvested.

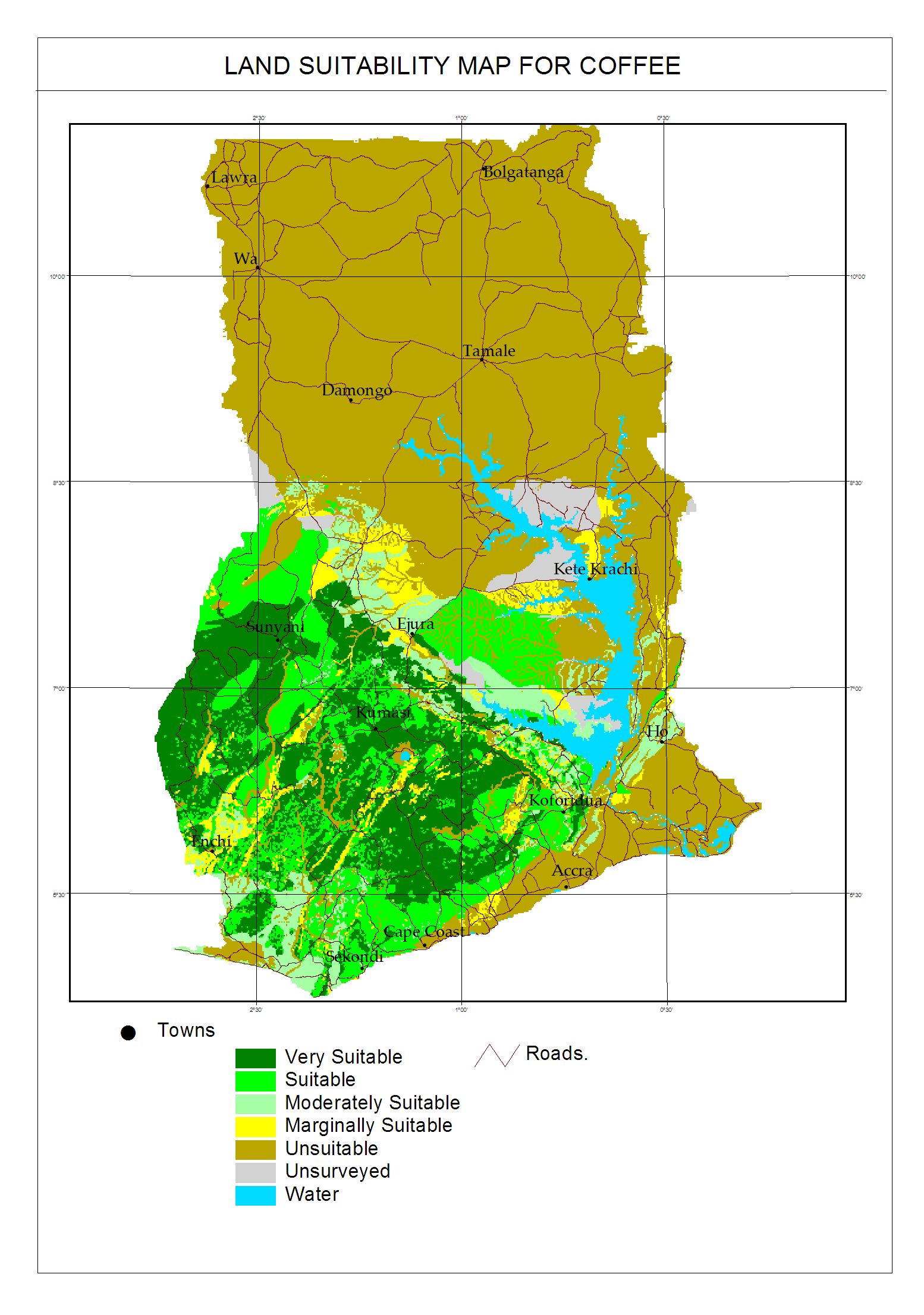

Coffee thrives well in three ecological zones in Ghana namely Rain Forest, Deciduous and parts of the transitional zones. The main regions for optimum coffee production includes Western North, Eastern, Ashanti, Western, Central, Ahafo, Bono, parts of Bono East, Oti and Volta regions as shown in figure below.

Ecological Zones and Coffee Growing Regions in Ghana

Coffee Production Cycle

The coffee production cycle starts from October to September. Planting material production and distribution starts from October which becomes ready for transplanting in March though late materials become ready by May. Distribution and planting take place between March and July. However, transplanting could be done in August if there is evidence of extended rainfall. Harvesting starts from August to February. It is estimated that harvest between August and September constitute about 20% of production annual production, 70% from October to December and 10% from January and February. This breakdown may vary slightly from geographical locations and weather conditions in previous year. It is important to note that in most flowering plants the climatic condition during the growing period can change the number of plants flowering which affect the maturation uniformity (Mesfin et al., 2019).

Production Cycle and General Crop year Activity Plan | |||||||||||||||

| Activity | JAN | FEB | MAR | APR | MAY | JUN | JUL | AUG | SEP | OCT | NOV | DEC | |||

| Planting material production |

|

| |||||||||||||

| Distribution of planting material |

| ||||||||||||||

| Land preparation |

| ||||||||||||||

| Planting |

| ||||||||||||||

| Farm maintenance |

| ||||||||||||||

| Harvesting |

|

| |||||||||||||

| Fertilizer Application |

|

|

|

|

| ||||||||||

Harvesting

Coffee harvesting in Ghana is done in two ways either by stripping or selective picking or both depending on the intensity of cherries ripening.

1. Stripping

This is very common between October and December which is the major harvest. Stripping involves holding one branch and pulling them together in one single motion. The whole coffee cherries are harvested at one time. Farmers mostly use this method when cherries ripen at the same time. The harvested coffee may not achieve the desired quality due to the mixture of under-ripen or overripe coffee cherries. Farmers in Ghana adopt this approach so as not to lose cherries through over-ripening. However, it is estimated that this method accounts for almost 10% loss of estimated harvest during that period in terms of weight lost and compromised quality.

2. Selective Picking

This method involves selection of only ripened cherries mainly by hand. Though cumbersome, labour intensive and requires several rounds of picking, it produces uniform and cleaner cherries that meets the desired quality characteristics in the cup.

Harvesting is mainly done by farmers, hired farms and sometimes the farmer groups, it is expected that through adherence to best harvesting techniques would improve harvest. However, knowledge on harvesting techniques and the availability of simple harvesting tools has constrained this expectation.

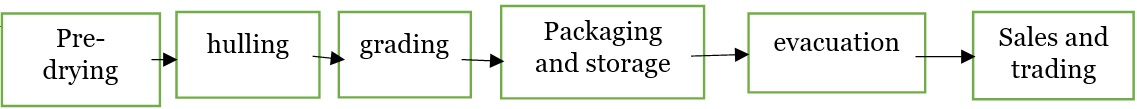

Post Harvest Activities

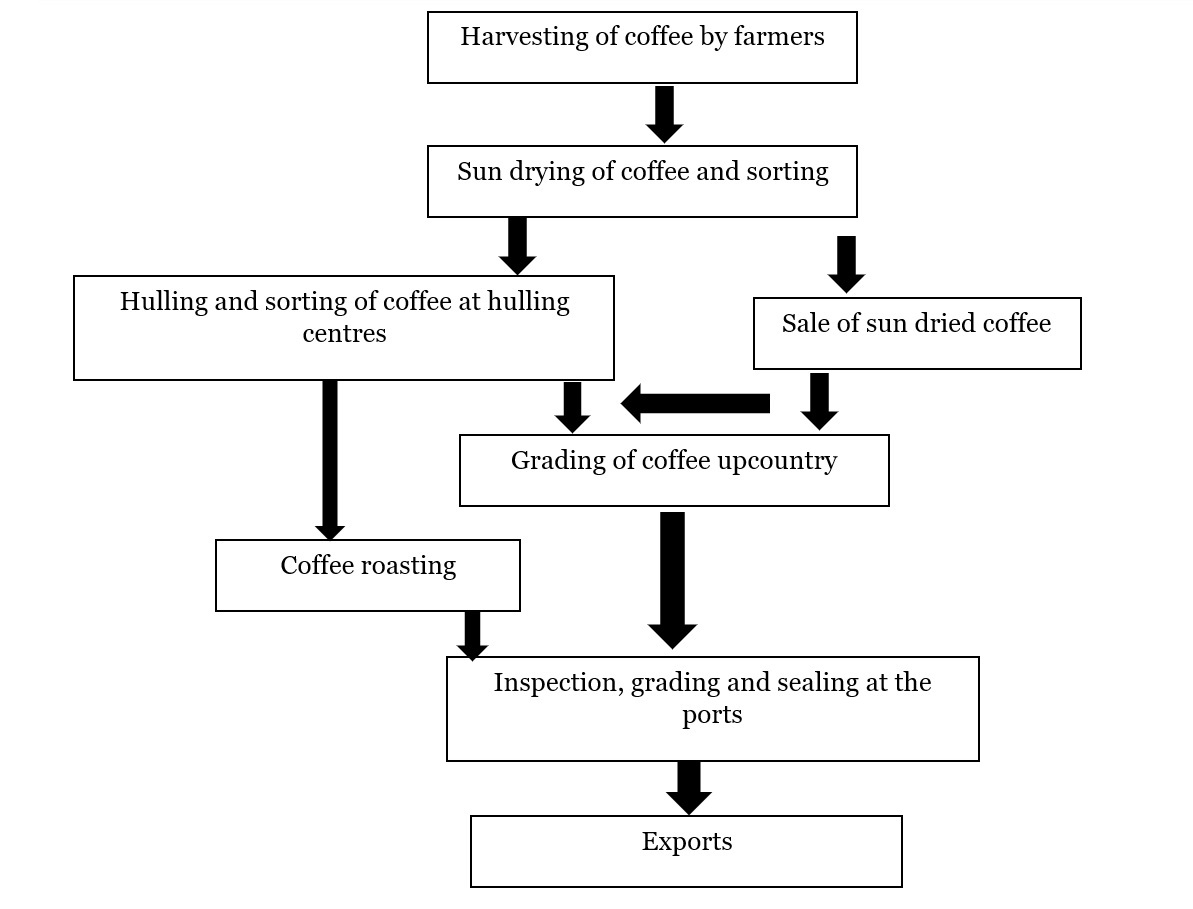

Post production processes involves post-harvest which include pre-drying handling, drying, hulling, grading, packaging and storage, evacuation and sale and trading.

Post Production Processes

Pre-drying handling

Coffee harvested through stripping process comes with many impurities such as green beans, dead branches, leaves, flower buds, etc. and farmers try to remove these impurities before they are transferred unto the drying mat. Sometimes a winnowing method is employed by using sieves with bigger holes.

Drying

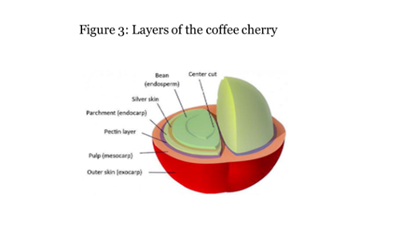

The coffee cherry is made of the outer skin (exocarp), pulp (mesocarp), Pectin layer, parchment (endocarp), silver skin and the bean, which is made up of the endosperm and the centre cut (detailed in Figure 3). The main purpose of drying is to make it easier to separate all the other layers from the bean which is the final required output.

There are two methods of drying – mechanical and sun-drying. With the mechanical drying, the beans are dried with hot air that passes through the machine and ensures uniform drying within shortest time. Currently, there is no mechanical drying installation in Ghana.

The main drying method in Ghana is the use of direct sunlight. Coffees produced through this method are called natural coffees. The materials used for sun drying are either the raised platforms made of bamboo and wood as done for cocoa drying or dried on large patios made up of cement with not more than 1% slope to facilitate water drainage. The raised platforms are normally used by the individual farmers whiles the patios are used by the estate farms.

The patios facilitate faster drying but same time drying is completed with many more unwanted materials through contaminations from materials carried by the wind such as broken pieces of wood, bottles and other poly materials. Though the raised platform takes a longer time for drying, it produces cleaner cherries.

Sun drying normally takes 3 three weeks depending on the prevailing weather conditions. Currently, there is no mechanical drying installation in Ghana.

The purpose of drying is to enhance the coffee quality attributes andalso to reduce the moisture content from 53% in the fresh harvest to the recommended 12%. It is also to facilitate the process of separating the parchment from the coffee beans. Poor drying can cause secondary fermentation if the mucilage which is very hygroscopic are left on the cherries. Poor drying can also lead to mouldy beans (deteriorations due to fungal and bacteria growth) which results in production of mycotoxins and degrades the quality aroma, taste and aroma of the final product in the cup.

To prevent this, ensure uniform drying of all cherries through frequent turning, at least three times daily. At the same time, it must be ensured that cherries are not over dried as this can result in excessive broken bean and affect the quality in the cup. One can determine that the coffees are properly dried when the bean rattle when shaken with a clenched fist.

It is worth noting that dry processing method produces coffees heavy in body, sweet, smooth but also complex characteristics.

Hulling

The sun-dried cherries come with the outer skin, pulp, pectin layer, parchment and silver skin fused together. Hulling is done to separate the green beans from the fused outer part of the bean mainly through a specially designed hulling machine. At the traditional hulling centres, winnowing must be done after hulling because the green beans come with many other foreign materials such as stones and these are separated using the sieve with suitable holes for easy dropping of the green beans. Further cleaning is required to clean the dirt that comes with the hulled beans. However, there is a modernised and automatic hulling machine (figure 4a) installed at Atwima Mim by the Plantation Resources Limited and this is the only commercial hulling centre in Ghana. The hulled coffees through this system comes out as most clean because the hulling system is able to hull, sort and grade. The system is able to separate undesirable materials such as broken beans, diseased and insect damaged, immature and black beans.

It should be noted that in Ghana, farmers do not hull their coffees but sell as coffee cherries. Hulling is mainly done by the exporters, roasters and in some cases the middlemen.

There are also government established hulling centres in Hohoe (Volta region) Bunso and Bepong (Eastern region), Nkawie (Ashanti), Dormaa Ahenkro (Bono region) but all these centers are non-operational. In most areas the parts of the machines have been decommissioned.

Quality Assurance (Grading)

Robusta Coffee grading is determined in-country. However, with emerging competing strengths of robusta on the global market, Coffee Quality Institute (CQI) and Ugandan Coffee Development Authority (UCDA) have categorized Green Robusta Coffee Defects into two categories, though there is a third category termed full defect.

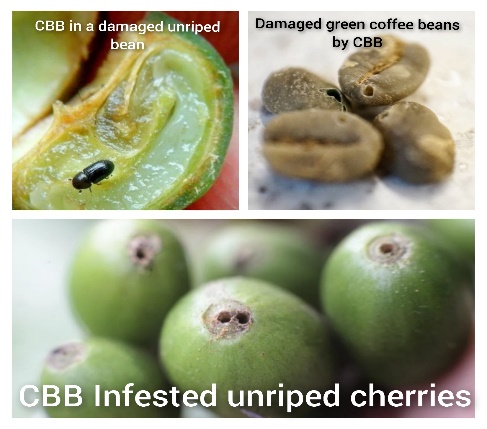

Category 1: Primary Defects - these are defects that have direct impact on the cup character of coffee which include full black, full sour, fungus or mould, damage, foreign matter, whole dried cherries or pods and sever insect damage.

Category 2: Secondary Defects – these defects impact the appearance of the coffee but not necessarily its cup character. These defects include Partial Black, partial sour, slight insect damage, broken, cut and chipped, immature, withered, shell, white or chalky, floater or spongy, parchment covered beans or husk pieces.

The Quality Control Company under COCOBOD has also develop quality grades to inform and regulate the Ghanaian coffee value chain. The Ghanaian coffee grading system has been categorised into three namely:

1) Superior Quality (Type 1) – Coffee of superior quality consists of clean dry beans, free from extraneous matter and mustiness (mouldiness). Not containing more than 20% by count of defective beans, the sample must not have more than 4% by count of black beans.

2) Fair Average Quality (Type 2) – Coffee of fair average quality consist of clean dry beans, free from extraneous matter and mustiness. It must not contain more than 25% by count of defective beans and not more than 8% by count of black beans.

3) Sub-Standard Quality (Type 3) – Coffee of sub-standard quality consist of clean dry beans, free from extraneous matter and mustiness. It must contain between 25% - 50% by count defective beans and not more than 8% by count black beans.

Packaging and Storage

Hulled coffees are allowed to rest before evacuated to roasting facility or exported. Storage conditions have direct effect on the sensorial qualities of the green beans and therefore all precautions must be taken into account. Due to the hygroscopic nature of the green coffee, it must be stored with the appropriate packaging materials under strict environmental conditions. At the storage facility though should be well ventilated, coffees should not be opened to direct light as the green beans will respire and loose its quality properties. Coffees must be stored in appropriate packaging material such as Jute sack packed on wooden platforms (pallets) which should be at least 3inches from the ground. The facility must be kept clean at all time and must serve the purpose of only green coffee storage. It should not be a place to store and pack other contrary materials such as oils, fuels, dust, broken coffee materials and coffee debris, etc.

The temperature and the relative humidity of the storage room play significant impact on the coffee quality in the cup as it can result in the loss of the intrinsic sensorial characteristics and physical and chemical properties. Extended exposure to higher humidity of about 60% causes cellular degradation leading to the reduction in the composition of reducing sugars in the green beans. This also causes oil leakage from the beans and under prolonged storage the oils become more acidic and it reduced the quality of the product.

Extension Services

Coffee extension service is mainly in the purview of SPD. Farmers are given access to up to date information on the input supply, on farm practices, marketing and pricing information. Periodically, scientist from CRIG visits the coffee farms and undertake community sensitization programmes on alternative livelihood support opportunities and improved household support systems.

Farmers and Farmer Cooperatives

The Ghanaian coffee farmer is averagely 53 years old with 13 years of experience in coffee farming and related on farm coffee activities. However, the most experienced farmers are found in Volta and Oti (at average of 17 years) and Eastern region farmer with at an average of 16 years’ experience in coffee farming.

As of 2016 there were very vibrant coffee producer associations such as Assin Coffee Farmer Association, Lineso Coffee Farmer Association, Future Hope, Wordiwoduna, Kayera, Ntomem, Brofrease, Likpe, Dormaa Ahenkro Area Coffee Farmers Association (DAACFA). A study conducted on the Ghanaian Coffee Value Chain by the Illy Foundation in 2016 found that 58% of coffee actors belong to one coffee association or the other with an average of 4 years in membership. With high interaction among members, key benefits for these members include Agronomic information on coffee, cash and other financial support, inputs especially cutlass and seedlings, farmer business schools and trainings, networking and other welfare support, market information and peer pricing, farm gate pricing negotiation skills. Currently only few of these associations are still active.

The Regulator - COCOBOD

By the ACT 1984 (P.N.D.C.L. 81), COCOBOD is mandated to regulate and develop the coffee sector in Ghana. Through its subsidiaries, COCOBOD carries out its development mandate in the area of Research and extension, Coffee diseases & pests management, rehabilitation projects, etc. Through CRIG, Coffee research has focused production and productivity, increase production of coffee and coffee by-product development. Research activities basically focused on developing high yielding clonal and hybrid varieties, soil and fertility requirements, disease and pest problems, quality of beans and the economics of production and market dynamics of the coffee industry in Ghana. Implementation of development programmes such as rejuvenation of coffee farms, planting material development and distributed freely to farmers are undertaken by CRIG and SPD.

On the pursuit of regulatory mandate, COCOBOD strategically focuses on internal marketing and quality assurance

Internal Market Regulation

COCOBOD mandate is restricted to the internal marketing of coffee in Ghana which is mainly undertaken by private sector. All companies must be licensed by COCOBOD before they can purchase coffee from the farm gate. Though COCOBOD mandate do not extend to export regulation, all exporting companies must provide the licence for the purchase of coffee from COCOBOD before export permit is given.

Quality Regulations

COCOBOD undertakes quality regulation obligations through QCC which basically concerns itself with coffee grading and sealing, inspection of facilities and produce, certification of storage facilities and other quality control roles.

Financing

Fidelity Bank Ghana, Agricultural Development Bank (adb) and the Ghana Commercial Bank [GCB] are some financial institutions supporting the coffee sector. ADB provides almost 80% of the total financial support to the sector.

Financing Farm Gate Purchases

This is mainly financed by the buyers’ funds. In some instances, others are successful with credit arrangements from the banks but that’s absolutely inadequate to support the sector. There are also instances that prospective buyers sometimes pre-finance the purchase of coffee from the farm gate through licensed companies whose capacity is not strong enough to undertake local purchases at a point in time.

Export Financing

Ghanaian exporters finance their exports mainly by their own funds or by bank . There are few cases of where some exporters have been successful with raising letters of credit.

___

Key Agronomic Practices and their Importance

Good Agricultural Practice | Brief Description and Importance |

Planting material | Hybrid and Clonal cuttings. However, in 2020, in its plan to make the Ghanaian coffee competitive, government abolished the use of seed based planting materials in favour of the clones. These materials must also be obtained from only CRIG or SPD. |

Nursery Establishment | Clonal planting materials are obtained from coffee wood gardens planted with improved coffee plants through rooting cuttings by CRIG. After preparing the cuttings from the wood gardens, the germinated cuttings are potted into polythene bag of 10 cm x 15 cm at the nursery for 6 months to be ready for transplanting. |

Soil requirement | The ideal soils for sustainable Robusta production is either volcanic red earth or sandy loams with good structure and texture and high rich in organic matter with pH of 5.5-6.5. Beyond this range plant performance will be impeded. |

Site selection | Select deep, fertile and well drained loamy soils. Soils must be rich in organic matter. Avoid rocky and water logging areas. Do not select land with very steep slopes. |

Transplanting | The establishment and subsequent growth and yield of coffee plants depend on how well field planting was done. Transplant into already prepared holes of 30cm by 30cm during the rainy season between April and July |

Agro Climatic conditions | The robusta coffee thrives well under altitudes of 900m – 1500m above sea levels. It requires an annual rainfall of 1200mm – 1800mm evenly distributed for at least 6 months and a mean optimal temperature range of 22ºC-30 ºC. |

Mulching | Mulching should be done immediately at the end of the rainy season. This is done to conserve soil moisture, boost soil fertility, control weed growth, regulates soil temperature and improves soil fertility. Materials that could be used for mulching include Dry plant material Coffee husk, Cocoa bean shell and in some instances plastic sheet. |

Shade Management | Shade management allows plants to grow and adapt well to the field especially at the younger stages. Plantain is the most recommended shade plant for coffee. Plantain planted at 3m by 3m. Pawpaw can also be used at 6m by 6m and Gliricidia sepium at 12m by 12m. It is advised that shade trees are planted 6 months before transplanting. |

Pruning | Removing all unwanted growth and or branches on the plant to have 2-3 stems per plant. Desuckering is a pruning method to remove suckers at the base of the plant. To aid harvesting and tree management, topping, another pruning method involves the control of the height of the coffee plant for not more than 2 meters. |

Pest and Disease Management

| The common pest infestation on Ghanaian coffees include stem borers, berry borer, ant infestation, termite infestation and the leaf miners. On the other hand the common diseases include leaf rust, brown eye spot, sooty mould, damping off, coffee berry disease. The general cause of both is poor on farm management practices and nutritional deficiencies. The general prevention and control measure of these diseases and pests is to adhere strictly to recommended agronomic management practices including proper nutritional management. |

Soil Fertility Management

| As continues coffee cultivation depletes the soil, it’s important to replenish the soil nutrient to sustain production at every stage of the coffee plant growth. For younger plants of 6 -18 months, ring application of 350kg/ha of NPK; 15-15-15 twice a year at the onset of the rain (April/May) and offset of the rain (September/October). Foliar fertilizers could be used. On mature plants, same timing for fertilizer application with 700kg/ha of NPK; 15-15-15. A well decomposed organic manure could be applied at 2.5 – 5 tons/ha/year |

Weed Management | The most retrogressive element on the field is weed competition. Apart from competition with coffee plants for nutrients, sunlight and water, weeds also play host to many diseases and pests. For this reason weed management must receive the greatest attention to weed 3 or 4 rounds per year. Generally, weed control is manually done. Application of weedicides or herbicides though convenient is not recommended. |

Harvest Management

| The current clones supplied to farmers takes a minimum of two years to reach maturity for first harvest. Coffee harvest start from August to February. Fly picking (first picking of early ripened coffee berries) is done within August and September and January and February. Stripping is most common harvesting practice on Ghanaian coffee farms. Though laborious, selective picking is most recommended as it optimised yield and ensure uniform quality produce. |

Coppicing | It advisable that after 6 years of harvest, the coffee plants should be coppiced. Coppicing involves cutting the coffee stems to about 30cm from the ground at 45 degrees. This slant is to ensure water is drained from the surface in order to avoid rotting of the surface. The best tool for this exercise is a chain to get a smooth cut. Coppicing is best done at the end of the dry season most preferably in February. Coppicing give the plants a new rejuvenated growth for increased yield. This should however be carefully planned as the coppiced farm will take three years for first harvest. Block coppicing is advised as it ensures consistent flow of income to the farmer. Divide the farm into 3 blocks. |

Drying

| The common method of drying is done on raised platforms. Harvest should be thinly distributed on the drying mats. Coffees in Ghana are dried with the cherries and therefore turning should be done at least 3 times daily for a minimum 21 days. |

___

Key Risks Along the Value Chain and Mitigation Measures

| Value Chain Actions | Key Risks and Challenges | Mitigation Measure |

| Input Supply | High Cost of fertilizers and chemicals Lack of interest among input suppliers to develop a programme for coffee farmers High use of unapproved fertilizers and chemicals Limited knowledge on available inputs and the effect of misapplication Limited knowledge on current coffee farms requirement | COCOBOD to develop an on farm support programme to make fertilizers and chemicals available and cheaper through subsidies as CRIG and SPD should rolled out a comprehensive on farm trainings for farmers on input applications and the effect of misapplication of fertilizers and chemicals CRIG should undertake coffee farm, survey to be able to determine soil and farm requirements to guide investors |

| Planting Material Production | Low capacity of production and propagation sites Inadequate technical personnel Limited competency of staff Climate issues and environment? | COCOBDO should support CRIG to undertake Accelerated expansion for both propagation and production sites CRIG should increase number and competency of site worker |

| Soil structure | Use of depleted and unsuitable soils | Soils must be tested for suitability for coffee production Eg. Iron deficiency causes Amber beans which have yellowish appearance |

| On farm production | Large number of unproductive plants on the farms, land acquisition and ownership, Subsistence nature of production, Scattered farming operations, Limited physical access to services, Low farmer motivation, little bargaining power on price, access to market information | COCOBOD should roll out a programme to replace all unproductive farms Farmer training on market information and price negotiation skills farmers mobilization and formalization of farmer groups COCOBDO can negotiate with land owners with compensation for long term coffee production |

| Extension service | Inadequate extension personnel Limited competency of existing personnel on coffee management. Huge gap on interaction between extension officers and the farmers | CRIG/SPD should deploy community extension agents to make access to extension services easier |

| Harvesting | Poor harvesting methods which leads to significant yield loss and compromised quality. | Training on harvesting methods or its impact on yield and farmers income |

| Drying | No mechanical drying systems in Ghana Natural drying system on concrete floors leads to high contamination of produce Crude way to determine the dryness of the cherries | Installation of mechanical dryers in selected areas for easy access to proper drying Commercial drying should install raised platforms or roll drying system Subsidies handy dryness tools |

| Hulling | No commercial and befitting hulling infrastructure in Ghana opened to the public. All hulling centres are not operational | COCOBOD should collaborate with globally recognized brands such as Pinhalense for installation of hulling infrastructure in selected coffee growing areas as it has done in eastern Africa and south and central Africa |

| Sorting and Grading | Limited knowledge of farmers on sorting procedure and grading system. Weak enforcement of grading system. Inadequate staff at QCC for grading of coffee at the farm gate | QCC should be retooled and trained to have the capacity to undertake its mandate Farmers should be trained on how to develop a sorting table -simple sorting and grading tools be made available to farmers at affordable price |

| Sale/trading | Unstable and unreliable producer price No defined trading center as coffees are sold from homes Conflicts and misunderstanding on the reaching agreement on price Changing agreed positions and decisions by farmers which affects the buyers | COCOBOD should institute and enforce the minimum pricing regime Private sector support to open buying centres to make sale of produce accessible

|

| Roasting | Cost of roasting machinery is high –unavailable toasting machines and parts Access to quality bean is difficult Unavailability of roasting professionals and technicians | Partnership with world class roasting brands which have guarantee arrangements with roasting companies in the Americas, such as Carmomaque S.P.A -training of the youth in coffee roasting and coffee businesses -technical training centres could integrate coffee roasting into their curriculum |

| Evacuation and storage | Poor transport system for green coffee evacuation Poor road network in the coffee producing communities Lack of storage facilities | District assembly should make the roads to the coffee producing communities motorable Private investment into warehouse construction for rental |

| Marketing | Increasing competition from Imported roasted coffees coupled with the effects from the undifferentiated coffee market Lack of market information with respect to markets dynamics, consumption and pricing. Access to market and lack of marketing centers Inadequate supply of green produce | Promotion campaign for Ghanaian coffees COCOBOD to make usable market information accessible to the farmers to radio and community programmes COCOBOD investment into coffee buying centres. This will provide convergence for the receipts and sale of green coffee. This will also ensure sustainable supply of green coffee |

| Export | Inadequate supply of green coffee bureaucratic processes at for export documentations | Construction of hulling and buying centres The documentation processes for export should be harmonised |

| Consumption | Low consumption among the Ghanaian populace Lack of technical expertise | COCOBOD in partnership with CRAG to hold promotion campaigns |

| Finance | Difficulty in accessible credit support for value chain investments High interest rate Difficulty in raising requirements for capital access which sometimes do not apply to the industry Lack of technical expertise at the financial institutions to undertake credit risk assessment on the part pf the value chain actors | GIRSAL to provide credit guarantee to the industry for actors to secure credit at competitive rate Banks to make their capital requirements applicable to the industry Banks must deploy financial and credit risk officer with agri background GIRSAL to roll out training support programmes for credit officers at the relevant financial institutions |

| Research and development | Inadequate technical expertise at COCOBOD to develop policy initiatives Underfunding of the coffee research activities at CRIG | COCOBOD must deliberately deploy staff with applicable expertise to focus on coffee development Funding to coffee research must be adequately be provided and released on time |

| Regulatory | Weak institutional support Unstructured sector Unregulated and scattered actors in the supply chain Limited interaction from the regulator with other actors (wide gap) | Accelerated actions to formalize the value chain COCOBOD must engage grassroots participation to understands farmers concern and prefer applicable |

___

Key Pests and Diseases

Major Coffee Pests and Diseases Management

Common Coffee Pests in Ghana

| Major Pests | Identification | Management |

| Coffee Berry Borer Hypothenemus hampei |  |

|

Coffee Leaf Miners Caterpillars, grasshoppers, skeletonizer |  |

|

Coffee stem borer

|  |

|

| Ants Infestation |  |

|

| Termites Macrotermes spp. |  |

|

Common Coffee Diseases in Ghana

| Major Diseases | Identification | Management |

Coffee Rust Hemeleia vestatrix |  | Lesions with orange yellow powdery spores develop on the undersides of leaves (Plate 37a). Infection becomes visible initially as pale yellow spots; the lesions enlarge and changes colour to yellow-orange. The lesions may coalesce with the lesion center being necrotic. The diseased leaves are shed prematurely resulting in reduced vegetative growth, progressive decline in vigour and yield. Severe rust attack on heavily bearing trees results in die-back of young shoots. Symptoms The first symptom is the formation of pale yellow spots up to 3 mm in diameter on the underside of the leaves. As the spots expand, they become powdery and yellow to orange in colour and may reach 20 mm in diameter. Occasionally the whole leaf becomes covered with rust spots. Older rust spores become brown at the centre surrounded by powdery orange spots. Leaf drop occurs, which if severe, can lead to dieback and berry loss and a loss of both yield and quality. Berries tend to be very small, not fully ripe and turn black |

Brown eye spot Cercospora leaf spot Other common names are coffee leave spot (on leaves), berry blotch (when on the berries)

|

| Caused by Cercospora coffeicola, the spots occur within the leaf, between the veins and the margins. Starts with small round spot and gradually extends to the margins with reddish brown and gray at the center which later turns the leaf as burnt. This is very common under poor nursery management. Mainly spread by wind and rain splash, high humidity, excessive water or rains, warm temperatures and drought stress after flowering are the most favorable climatic conditions for its rapid infestation On berries, the blotch appears as brown sunken lesions on the green berries surrounded by a bright red ring. Prevention At the nursery avoid over wetting the soils, maintain the required shade cover, proper fertilizer application and space out the potted bags to allow easy flow of air. This should be done before chemical application Control Use the recommended copper application such as 80g/20L of copper cupravit and same for copper hydroxide. |

| Coffee berry disease |   | Caused by Colletotrichum coffeanum, it affects the flowers as well as green and ripe berries. On flowers, dark brown blotch or streak on the white tissue is observed and flowers may be destroyed. The fungus invades the berry during the green stage (4–14 weeks after flowering) producing dark brown spots that end up covering the cherry and affecting bean development and quality. Prevention Prevent the accumulation of standing water to limit the spread of the disease. Remove old stems and strip off diseased berries to reduce sources of disease. Prune the coffee trees to increase flow of air through the foliage; this also enables them to be sprayed effectively. Spray fungicides at the onset of flowering for 5 months. Control Spray twice a month, on top of the foliage. Spray either with Chlorothalonil or Copper fungicides at (4 l/ha). This will protect the coffee berries until harvest. |

| Sooty mould |   | Sooty mould (Capnodium spp.) develops when the plant is infested with scale, mealybugs, aphids or other sucking insects. Symptoms Leaves covered with black, powdery soot. The fungus grows on honeydew produced by green coffee scale and sucking insects. Ants care for the scales and spread the sooty mould. Prevention: Reduce levels of coffee scale, aphids and mealybugs by using recommended control procedures. Chemical: Not needed if sucking insects are controlled. Control the insects, not the disease |

Damping Off

Commonly found at the nursery |   | This disease occurs on young coffee seedlings in the germination bed, after germination and before transplanting. It is caused by a fungus,Pythium spp. This happens due to overwatering, high planting density, dense shading and acidic soils Symptoms Patches of coffee die quickly. Coffee stem is soft and rotten. Prevention: Avoid using old soils as this may host other pathogen. Use new soil for nursery beds and potting-up. Avoid over-watering. Do not plant seed too close; seeds should be 25 mm apart in rows 100 mm apart. Chemical control: Soil drenches of either Benlate (Benomyl) or Captan. |

There is no documented evidence of the economic losses from the coffee pest and disease infestation in Ghana.

___

Processing and Value Addition

Roasting and Grinding

Roasting in Ghana is mainly done by the Coffee Roasters Association of Ghana and the artisanal roasters.

Roasting is the critical action for the formation of desirable aroma, colour and development of flavour properties. The type and roasting degree and the final temperature in the coffee beans influence the development of the flavour profile, taste and the desired aroma. The most common roasting types are;

Light roast

The objective of the light roast is to create coffee with mild body. Mostly characterised by floral or fruity note as the beans are not allowed to develop oil on the surface. With the internal bean temperature around 200ºC, the light roasted coffee has strong acidity and caffeine content.

Medium roast (City roast)

With the development of medium brown colour, beans through medium roast do not have oils. It also has a good balance between the acidity level, aroma and flavour. This is the most common among Ghanaian coffee drinkers. It has medium caffeine content and final internal bean temperature of approximately 215 ºC. Beans roasted at this level completes the first crack.

Medium-dark roast (full city roast)

Medium roasting creates medium brown bean colour but oils can be found on the surface pf the bean. With a fully bodied deep flavoured and little spicy notes, the full city roast has low caffeine content. All these properties are attained when the internal bean temperature is reaches 229°C. Beans roasted through this type completes the full first and second crack.

Dark roast

This roast produces dark colour and oils on the bean surface. It worth noting that the darker the roast, the less the acidity. With internal bean temperature of 246°C, the dark roast creates beans with very low caffeine content with heavy mouthfeel, strong flavour, bitter, and burnt or smoky.

Marketing and Branding

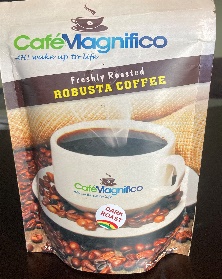

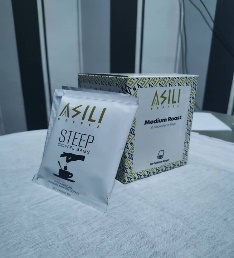

The main markets for the elite roasters are HORECAs (Hotel, Restaurant, Café/Catering) and retail shops such as the malls and supermarkets. Products from CRAG follow well defined accepted roasting protocols and the use of modern roasting machineries. Products are highly differentiated and branded. The products sold in pack of 250grams averaging between GHS40 and GHS50. These roasters operate in Greater Accra and Eastern regions. Key among these roasters are Asili Purveyors located in Akuapem Akropong, Café Magnifico and Gold Coast Coffee located in Accra.

The artisanal roasters, currently not organized, are the second group which targets the local traditional markets such as Kejetia in Kumasi and Makola in Accra. Their products do not follow any quality protocol and the methods of processing are rudimentary. Tools and equipment used are locally designed and sometimes not fit for purpose. Products from this processing come out as the fine ground and the main consumers are local residents. The processed coffees are sold in 1-5kg packs sold between GHS85 and GHS250.

List of Coffee Roasting Companies

| Company Names | Location | |

| 1 | Asili Coffee Purveyors | Akropong Akuapem |

| 2 | Gold Coast Roasters | Accra |

| 3 | Café Magnifico | Accra |

| 4 | Ziavitutui | Accra |

| 5 | Bean Masters | Accra |

| 6 | Kawa Moka | Accra |

| 7 | Jamestown Coffee Roasters | Accra |

| 8 | Royal Coffee | Kumasi |

| 9 | Bongo Coffee | Kumasi |

| 10 | Gye Nyame Coffee | Kumasi |

Grinding, Brewing and Consumption

Grinding is deployed on the roasted coffee by use of specially designed grinders and this could be mechanical or electrical. Other homes (mostly in Accra) use blenders whiles traditional homes of some families especially in the Volta region can use pestle and mortar. Grinding is purposely done to increase the surface area of the roasted beans.

Grinding degree is influenced by the consuming demand typified by the type of coffee brew expected.

The table below explains types of coffee ground.

| Types of coffee ground and suitable brew (adopted from kitchen sanity) | |

| Coffee Ground | Brewing method |

| Extra Fine | Turkish |

| Fine | Espresso |

| Medium Fine | Moka pots |

| Medium | Drip and vacuum brew |

| Medium - Coarse | Chemex brew |

| Coarse | French press and Percolators |

Typical Ghanaians are not coffee consumers. However coffee consumption in Ghana has soared significantly in recent times mainly due to the influx of modernity lifestyle and increasing population of the middle age group. Though a significant proportion of the coffee consuming population in Ghana is estimated to brew their own coffees at home or offices. Coffee is mainly brewed and consumed at the Hotels, restaurants and the cafes (HORECAs).

Coffee brewing is mainly dependent on personal preferences, geographical location, the culture, social, and finance. Brewing has significant impact on the quality of the brew. The extraction is mainly influenced by the water quality, the brewing pressure, the type of brewing machine and temperature of the water.

The amount of the extract is mainly influenced by the size of the ground coffee. The finer the ground, the slower water penetrates and would require pressure during brewing. This type of ground is mainly used for expresso. On the other hand, the coarser the ground the faster the water penetration, and the less contact the water with the ground coffee. The best brewing method for such is the pour-over and sometimes the French press and the AeroPress used.

___

Marketing and Trade of Coffee

Coffee Market Updates

- The ICO Composite Indicator Price (I-CIP) averaged 151.94 US cents/lb in October, a 0.8% decline from September 2023. The I-CIP posted a median value of 151.58 US cents/lb, having fluctuated between 145.99 and 160.09 US cents/lb.

- The Colombian Milds-Other Milds differential grew 38.5% to 2.02 US cents/lb.

- Arbitrage, as measured between the London and New York Futures markets, widened by 13.7% to 50.51 US cents/lb in October 2023.

- Intra-day volatility of the I-CIP remained stable at 6.3% between September and October 2023.

- The New York and London certified stocks moved in the same downward direction.

- Global green bean exports for coffee year 2022/23 were down 5.5% to 110.81 million bags from 117.28 million bags in coffee year 2021/22.

- Shipments of the Other Milds decreased by 12.1% to 22.11 million bags in coffee year 2022/23 from 25.16 million bags in coffee year 2022/21.

- Exports of the Colombian Milds dropped by 11.2% to 10.77 million bags in coffee year 2022/23 from 12.14 million bags in coffee year 2021/22.

- Green bean exports of the Robustas for coffee year 2022/23 were up 2.6% to 43.76 million bags from 42.66 million bags in coffee year 2021/22.

- For coffee year 2022/23, South America’s exports of all forms of coffee decreased 11.0% to 50.59 million bags from 56.83 million bags in coffee year 2021/22.

- Exports of all forms of coffee from Africa decreased by 1.4% to 13.53 million bags in coffee year 2022/23 from 13.73 million bags in coffee year 2021/22.

- Mexico & Central America’s exports of all forms of coffee were down 3.1% to 15.3 million bags in coffee year 2022/23 from 15.78 million bags in coffee year 2021/22.

- In coffee year 2022/23 Asia & Oceania’s exports of all forms of coffee were down 0.9% to 43.56 million bags from 43.95 million bags in coffee year 2021/22.

- Total exports of soluble coffee decreased by 5.7% to 11.47 million bags in coffee year 2022/23 from 12.16 million bags in coffee year 2021/22. For coffee year 2022/23, soluble coffee’s share of the total exports was 9.3%, the same as in coffee year 2021/22.

- For coffee year 2022/23, roasted coffee exports were down 16.0% to 0.71 million bags from 0.84 million bags in coffee year 2021/22.

- World coffee production decreased by 1.4%, year-on-year, to 168.5 million bags in coffee year 2021/22; however, it is expected to bounce back by 1.7% to 171.3 million bags in 2022/23. World coffee consumption increased by 4.2% to 175.6 million bags in coffee year 2021/22. It is expected to increase by 1.7% to 178.5 million bags in coffee year 2022/23.

- As a result, under the current circumstances, the world coffee market is expected to undergo another year of deficit, with an estimated shortfall of 7.3 million bags in coffee year 2022/23.

Sales/Trading

The green coffee is mainly sold at the farm gate mainly by the LBCs. These LBCs could be roasters, middlemen or exporters. Coffee sales takes place at the farm gate by any of the three actors – roaster, middlemen and exporter.

Coffee is purchased from farmers after drying. At the farm level coffees are sold in the parchment.

According to the Ghana Statistical Service 75.4% of the households that harvest sell only the green (unprocessed). The roasters and exporters (who are mainly licensed by COCOBOD) purchase the cherries and further hull and add value before either sell, roast or export.

Mostly the buyer need to travel with sacks to be able to transport the purchased goods since there is no packaging materials available to the farmer. Farmers mostly store their coffees in used containers and inappropriate sack.

The producer price is sometimes announced by COCOBOD but the actual price of coffee at the farm gate is basically determined by the market forces influenced by the negotiating skills and depth of market information owned by the farmer and the buyer. Though COCOBOD is expected to regulate the coffee pricing regime but this over the years has become ineffective. The producer price determined is subjected to the party with the bargaining power. Ghanaian coffee producers become generally price takers. Producer price for the first grade coffee, moistly produced by CRIG, has been sold at an average of GHS8, 500 per tonne for the last 5 years (2017- 2022). As at April 26, 2022, the grade A is selling at GHS9, 000 at the CRIG station.

The Ghana Statistical Service estimated that the annual value of total harvest and total sales in 2014 stood at GHc4.06million and GHc3.03 million respectively.

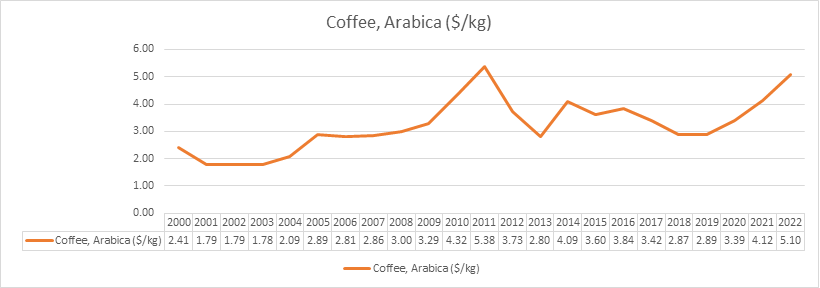

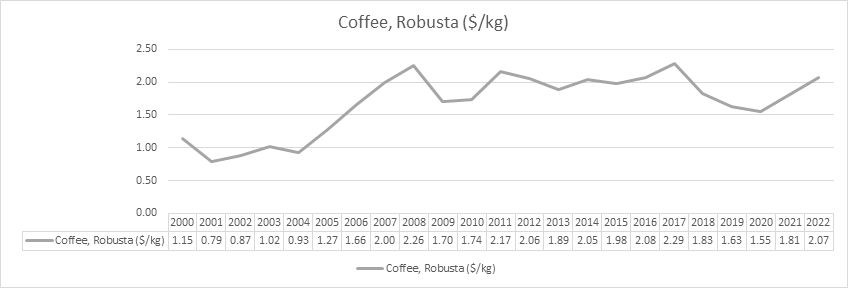

World Prices of Arabica and Robusta Coffee 2000- 2022

Analysis of the Marketing Margins

As defined marketing channel for the sale of coffee in Ghana, direct from farmers through roasters to consumers, analysis was done in the perspective of the elite roaster and the artisanal roaster. From the table below two different types of green coffees are purchased from the producers – hulled graded and unhulled ungraded. The large marketing margin of 97.4% indicates high percentage of what the consumer pays for each selling point along the supply chain from the producer of unhulled ungraded coffee purchased by the elite roaster. The producers’ margin of 99% explains that the producer makes more from the sale of hulled coffee to the artisanal roasters.

Analysis of market margins for Ghanaian Coffee | ||||

| Green coffee type | Hulled and clean (Highest grade) | Unhulled ungraded | ||

| GHS/kg | 9 | 4.7 | ||

| GHS/g | 0.009 | 0.0047 | ||

| Roasters | Elite | Artisanal | Elite | Artisanal |

| GHS/g of roasted ground gourmet coffee on the retail or local market | 0.18 |

0.01 | 0.18 |

0.01 |

| Price Spread (GHc/g) | 0.171 | 0.001 | 0.1753 | 0.00053 |

| TGMM (%) | 95.0 | 10.0 | 97.4 | 53.0 |

| GMMp (%) | 10.0 | 99.0 | 5.2 | 71.9 |

Coffee Export Processes in Ghana

The Coffee Buyers and Exporters association (COBEA) stands as the most recognized coffee association in Ghana. However, in recent past this association has been struggling due to internal wranglings, weak government support and also the decline in coffee exports. Most of these members have abandoned the coffee business and diverted into other export of other commodities.

Import and Export

Due to the low volumes of coffee production, quality constricts, and the demands of the consuming population, roasters sometimes import Arabica and fine robusta. Though Ghana coffee exports quantity fluctuated substantially in recent years, it tended to decrease through 1969 - 2018 period ending at 18 tonnes in 2018 (Knoema, 2022).

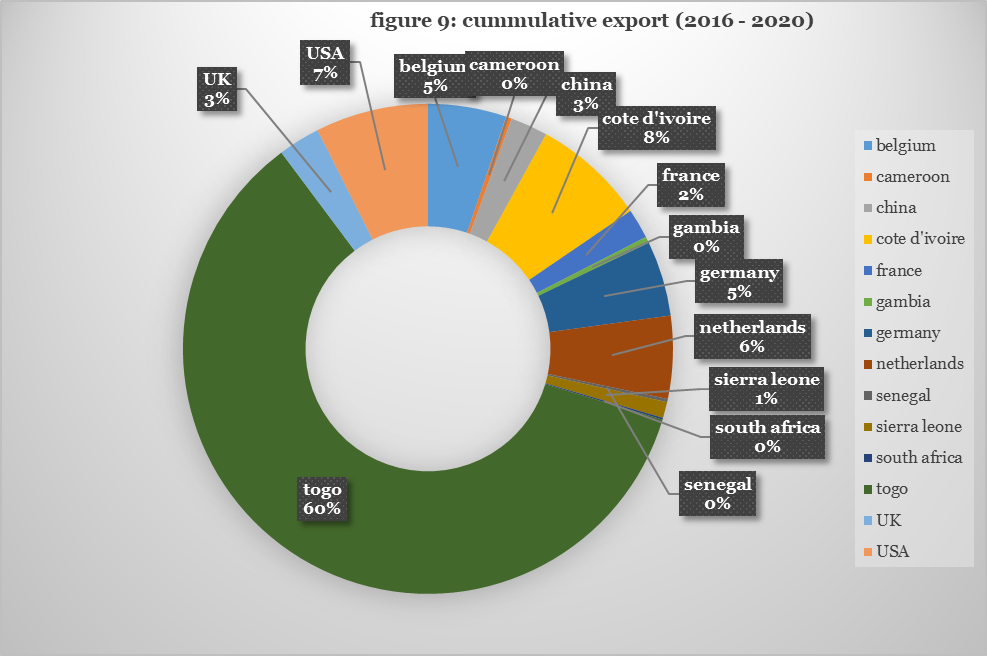

The main products of coffee export are green and roasted ground. Currently there are about 32 coffee exporting companies in Ghana with exporting destinations mainly in Europe and the West Africa market. The European countries are mainly Belgium France, Germany, Netherlands, and United Kingdom. The West African market are in Cameroon, Ivory Coast, Senegal, Sierra Leone and Togo. There are some few exports to China and South Africa.

It is worth noting that the top 3 exporting companies contribute over 83% of the cumulative exports from 2016 – 2020. However, the major exporter, Al-Noad Company alone exported 68% of total exports between 2016 and 2020. The other two top exporters are Carel industries and Chegus Commodities with a combined total export share of 0.14%.

Exports of all forms of coffee by Ghana in thousand 60kg bags

2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

24 | 7 | 72 | 30 | 23 | 26 | 40 | 27 | 17 | 12 | 10 |

Source: International Coffee Organization

List of Top Coffee exporting Companies and their cumulative market share (2016 - 2020) | ||

| Company | Share | |

1 | Al - Noad Company Limited | 64.01 |

2 | Carel Industries Limited | 21.31 |

3 | Chegus Commodities Limited | 5.26 |

4 | Quaye Coffee Beans Enterprise | 2.83 |

5 | Fa Brands Limited | 2.68 |

6 | Time Marketing Company Limited | 2.09 |

7 | Fegmasda Limited | 0.51 |

8 | Uno Premier Ghana Limited | 0.40 |

9 | Henacent Limited | 0.33 |

10 | Chaka Zulu Ventures Limited | 0.35 |

11 | Aramex Express Limited | 0.12 |

12 | Adwoa Adutwumwaa | 0.02 |

13 | Helina Asumadu | 0.02 |

14 | George Shikor | 0.01 |

15 | Subsea 7 Volta Contractors Limited | 0.01 |

16 | Gif-Geo Farms | 0.01 |

17 | Richard Manu | 0.01 |

18 | Edwin Darko | 0.01 |

| Source: GEPA | ||

Cumulative Coffee Exports from 2010 – 2015

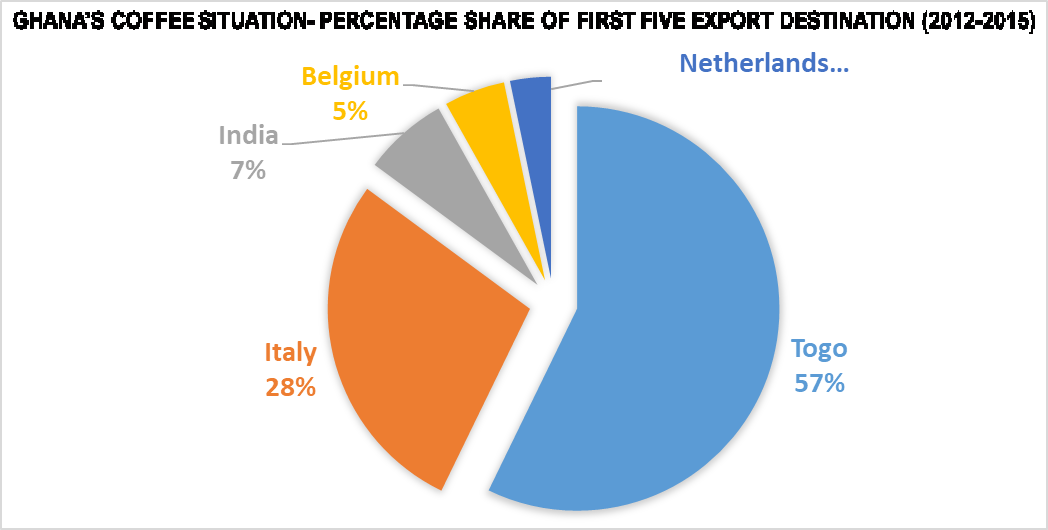

The six-year export analysis show that Togo remains Ghana’s major export destination of coffee, 57 percent of Ghana’s coffee is exported to Togo, followed by Italy which imports 28 percent of Ghanaian coffee.

Cumulative Exports from 2016 to 2020

The figure above shows that the US and the European markets have become the emerging destinations for the demand of Ghanaian robusta coffee. That notwithstanding, Togo remains the highest export destination of Ghanaian coffee holding 60% of cumulative exports from 2016 - 2020.

Schematic representation of coffee supply chain from producing to consuming country

___

Coffee Growing Seasons and Cropping Cycle

Production Cycle and General Crop year Activity Plan | |||||||||||||||

| Activity | JAN | FEB | MAR | APR | MAY | JUN | JUL | AUG | SEP | OCT | NOV | DEC | |||

| planting material production |

|

| |||||||||||||

| distribution of planting material |

| ||||||||||||||

| land preparation |

| ||||||||||||||

| Planting |

| ||||||||||||||

| farm maintenance |

| ||||||||||||||

| harvesting |

|

| |||||||||||||

| Fertilizer Application |

|

|

|

|

| ||||||||||

___

Key Policies and Programmes in the Coffee Sector

Feeding from the gains through the Planting for Export and Rural Development (PERD) Programme, the Ghanaian coffee sector is undergoing institutional rationalization for COCOBOD to create a coffee division. The coffee division has the mandate towards developing the coffee sector and pursuing regulatory reforms towards formalizing the Ghanaian coffee sector.

Tree Crop Policy: The government’s tree crop policy has identified coffee as one of six tree crops to be supported to reduce the country’s over-reliance on cocoa. The policy is expected to boost the coffee sub-sector to ensure that the crop generates approximately $2 billion in foreign exchange annually. In this regard, COCOBOD and MMDAs have been tasked to improve access to good planting materials, extension services and other conditions to help move the sector to the next level.

In addition, they are to ensure a competitive and growing local market characterized by high demand for the produce, reliable and increasing farm gate prices, increasingly high farmer motivation and growing interest among the youth. The Ghanaian coffee sector today presents enormous opportunities for the youth and farmers in general, as the new policy direction of the government will provide impetus to transform the sector immensely.

___

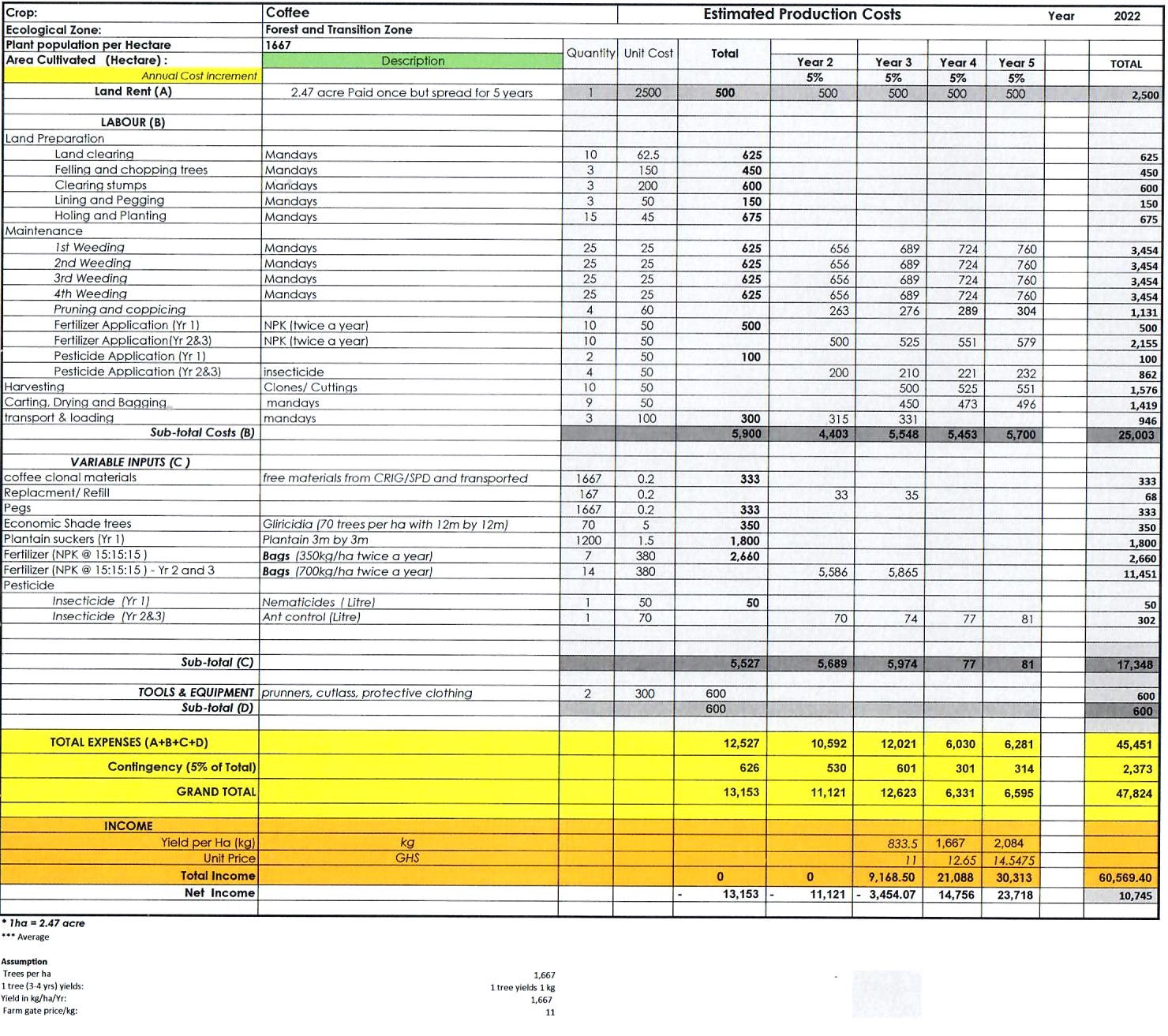

Enterprise Budget for Coffee, YR 2022

___

Other Resources in Coffee sector

1. COCOBOD https://cocobod.gh/pages/coffee

2. The Coffee Guide https://intracen.org/publications/coffee-guide

The Coffee Guide is the world's most extensive, hands-on and neutral source of information on the international coffee trade. It covers trade issues relevant to coffee growers, traders, exporters, transportation companies, certifiers, associations and authorities, and other relevant actors. Many in the coffee industry consider it the go-to reference.

3. Ghana Coffee https://espressocoffeeguide.com/gourmet-coffee/arabian-and-african-coffees/ghana-coffee/

4. Coffee Sector Lending https://collaboration.worldbank.org/content/sites/collaboration-for-development/en/groups/agrifin/products.entry.html/2019/07/08/coffee_sector_-_bpr-Z5SC.html

The coffee sector lending document discusses the characteristics, production volume, and relevant national facts and figures of the commodity. The sector note also describes the value chain linkages (from production to market), arrangement, activities, and actors involved.

5. Production risks in the coffee sector https://collaboration.worldbank.org/content/sites/collaboration-for-development/en/groups/agrifin/products.entry.html/2019/06/27/production_risksin-0pmH.html

This table has been prepared as part of the World Bank’s Agriculture Global Practice Discussion Paper on improving the risk management and access to finance in the coffee sector. It provides an overview of the major risks facing primary production and processing, along with an assessment of the frequency and impact of risk.

6. Marketing risks in the coffee sector https://collaboration.worldbank.org/content/sites/collaboration-for-development/en/groups/agrifin/products.entry.html/2019/04/30/coffee_sector_market-bfTs.html

This table has been prepared as part of the World Bank’s Agriculture Global Practice Discussion Paper on improving the risk management and access to finance in the coffee sector. It provides an overview of the major risks facing coffee sector marketing, along with an assessment of the frequency and impact of risk.

7. Risk and Finance in the Coffee Sector https://collaboration.worldbank.org/content/sites/collaboration-for-development/en/groups/agrifin/products.entry.html/2019/06/27/risk_and_financein-Sz1R.html

This World Bank discussion paper examines the risk management and access to finance in the coffee sector. More specifically, the paper outlines: 1) major risks and constraints facing the sector; 2) potential opportunities for improving the management of certain risks; and 3) programs launched in various regions aimed at improving access to finance. In addition, the paper explores the role that producer associations, governments, non-profit organizations, the private sector, and other intermediaries can play in making risk management and financing tools more accessible and more workable for smallholder coffee growers.

___

Soil Suitability Map for Coffee

___

Agriculture in Africa Media | Email: Ghana@agricinafrica.com

References: FAO, Agriculture in Ghana Facts & Figures, Syecomp, Ghana Cocoa Board

___

Comments

Post a Comment